What even ARE Deferred Sales Trust and 1031 Exchange?

In this session of Meeting with the Masters we have Greg Burns of IPX1031, as well as Joel Harworth and Philip A. Board from 1 on 1 Financial here to discuss the ins and outs of 1031 Exchanges and Deferred Sales Trusts and how to use them to your advantage. If you prefer to listen to the recording of the episode, you can hear it here: https://www.buzzsprout.com/95458/776479-1031-s-deferred-sales-trusts-opportunity-to-parlay-proceeds-on-sale-of-income-property . As always, you can subscribe to our podcasts on

Itunes: https://itunes.apple.com/us/podcast/ryan-j-orrs-podcast/id1226680688?mt=2,

Stitcher: https://www.stitcher.com/podcast/ryan-j-orr/team-title-guy

Or Spotify: Spotify:show:6DsOeUTqaDia9b6gg5wBB1

The Masters Team: Greg Burns, Philip A. Board, Ryan J. Orr, Joel Harworth, and Ron RomeroThis discussion is going to be based upon the answers to the question what should you do with appreciated assets you want to cash in on? The answers to this question are as follows: Sell and pay the astronomical taxes on them, do a 1031 Exchange, do a Deferred Sales Trust, or just hold onto your assets. We’ll be discussing everything about the middle two options because the others are self explanatory.

Why Do a 1031 Exchange & What are the Limitations?:

- 1031 tax code says that if you sell a property for investment or business use to exchange for another real estate property whose initial intent of purchase must be investment or business use, you can defer the tax.

- Why is deferring the tax such a big deal? The tax on a real estate sale is HUGE, at 24.3% as the bare minimum in the state of California.

- So you want to 1031 exchange for a duplex you rent out in order to buy an “investment property” in Hawaii a few years before you’re ready to retire. Now you can defer all tax to the sale as long as you have a minimum of 2 weeks of income per year. If client makes any repairs, it does not count against the two weeks, so people tend to “do repairs” and stay there for a while.

- Now, say you plan on using this investment property as your retirement property a few years down the line. The purpose of the exchange is strictly for investment or business use, but after a minimum of about 2 years of use as an investment you have the ability to use it as you please without risking the IRS coming after you about it.

- 1031 is not a condition of sale, you can notify the buyer, but don’t need to advertise it as the buyer does not have to have anything to do with the exchange. However, when writing up the contract for the sale you must put in language stating that the seller is doing an exchange and you furthermore must hire a company that does 1031 exchange in house like IPX, they have 45 days after the escrow closes to identify a property to exchange (loophole for that is listed in the process of an exchange section).

Now that we have that out of the way, we can discuss the…

Now that we have that out of the way, we can discuss the…

Process of a 1031 Exchange:

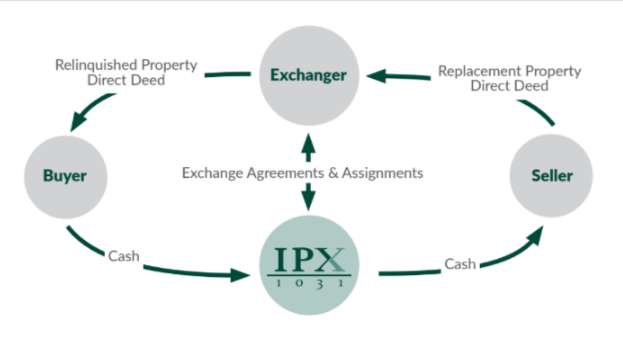

- Prior to closing the sale of the Relinquished Property the Exchanger and a Qualified Intermediary must enter into an Exchange Agreement which requires the Qualified Intermediary to

- acquire the Relinquished Property from the Exchanger and transfer it to the buyer (by direct deed from Exchanger to buyer)

- acquire the Replacement Property from the seller and transfer it to the Exchanger (by direct deed from seller to Exchanger).

- Also prior to closing the sale of the Relinquished Property, the Exchanger must assign rights under the Relinquished Property sale contract to the Qualified Intermediary and provide notice of assignment to the buyer.

- At closing, net proceeds from the Relinquished Property sale (exchange funds) are paid directly to the Intermediary to be held in a separate account for the Exchanger until used to purchase Replacement Property.

From here, the Exchanger now has the responsibility to find a suitable exchange property. They are given 45 days after escrow closes to identify property, with the possibility of a 21 day post-escrow window and a further possibility to appeal for a 15 day extension; this sums up to a total possible 81 days to identify property which should allow for plenty of time for the Exchanger to decide.

There are 3 main rules to identifying one or more properties to acquire in the exchange which are as follows:

- The 3 property rule- the maximum number of properties that can be acquired under normal circumstances is 3.

- The 200% rule- the aggregate value of the properties can not exceed 200% of the selling value of the property that had initially been exchanged (again also under normal circumstances).

- The final rule is called the 95% rule and really only exists as an exception to the first two rules and is extremely uncommon. What it does is allows for more than 3 properties worth up to and exceeding 200% of the original’s selling value to be purchased in the exchange provided that the Exchanger acquires 95% of the total sum value of the identified properties within the exchange period. This effectively never happens in practice and the rule can almost essentially be ignored.

- Once the property has been identified, there is a 135 day period during which the property is to be purchased and the Exchange comes to a close.

Now that we know what a 1031 Exchange is, it’s time to cover our second big answer to our question…

What is a DST, and why do I want one?

- Simply put, a deferred sales trust is a financial vehicle that allows investors to transfer highly appreciated assets to a trust for the purpose of deferring payment of capital gains taxes and generating an income stream. These trusts are an alternative to 1031 exchanges and direct sales and can protect your assets from being too highly taxed.

- A DST is a contractual arrangement between an individual and a trust in which the individual sells property to the trust in exchange for the trust’s agreement to pay the individual a certain amount over an agreed period of time.

- Deferred Sales Trusts are completely legal as they have been reviewed by the IRS, FINRA, as well as National Tax Law Firms

- 1031 timelines and restrictions make it difficult to find a quality deal, especially combined with the lack of inventory to choose from.

- Interest rates in the US are hovering near 40 year lows.

- Investors can allocate more funds to their portfolio than what would result from a direct sale.

- DSTs can be used to invest back into real estate or a business, . As long as the money stays in the trust and does not go directly back to you without first going through the trust, you can do virtually anything with it.

Process of a Deferred Sales Trust:

- Go to MyDSTPlan.com and get in contact with the Estate Planning Team. The EPT is a group of legal and financial service professionals dedicated to helping preserve wealth and protect estate. Deferred Sales Trusts are exclusively offered by the EPT along with a handful of specialized tax attorneys with unique experience.

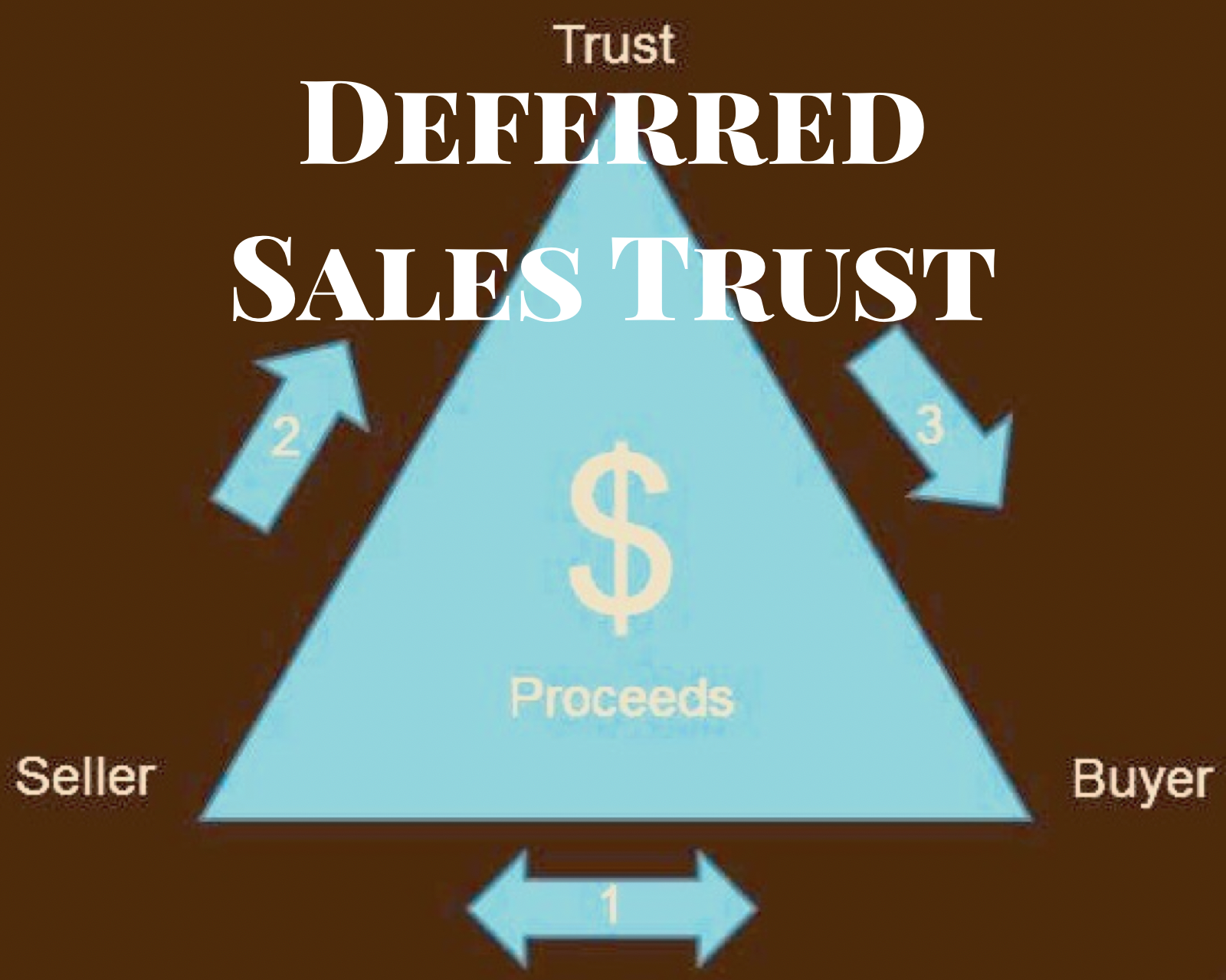

- Assets to sell are sold to a third party trustee in consideration of a secured DST installment contract

- The third party DST trustee buys the assets, who sells them to a cash buyer

- The cash buyer pays to the trust in exchange for the assets

- The secured DST installment payments are made to the seller from the trust

- DST payout timeline: the trust is written in 10 year increments traditionally up to 30 years, but can be extended out 10 years at a time indefinitely; meaning that the payout can be extended to 40, 50, or more years as long as you are willing to adjust the payout to fit the newly adjusted timeline.

FAQ:

- Is there a fee for the DST? Generally speaking it will be 1.5% to write the trust, and a trust deed fee, 25 to 50 point basis fee, 1% advisory fee, and small management fees.

- Can two parties join in a 1031 together to buy a new property together? Yes, both parties can be involved in a 1031 and do it so long as they keep the same taxpayer and make tenants in common.

- What happens if you are involved in a reverse exchange? The buyer cannot have both properties in your name at the same time so the 1031 exchange company creates an LLC to buy the property, buyer loans money to buy the house, do a NNN lease agreement, then do a proper 1031 exchange if the property closes.

- What is a NNN lease agreement? It is an agreement that the lessee is to take care of all repairs and renovations to the property being leased. Many major companies go into NNN leases when they have chain stores such as Home Depot or McDonalds.

Comments(0)