Pricing in the Land of "No Comps"

Denise offers 5 innovative ways to arrive at a valid listing price when there are "no comps." I think agents should print this list and refer to it every time they run into one of these difficult-to-price listings.

Pricing in the Land of "No Comps"

Agents already list confidence in pricing as one of the biggest challenges in their business. But throw a property in the mix with few or no current comparables and you might throw up your hands and declare a, "comparable calamity!"

But armed with just a few pricing tools, you can walk into a seller's home with confidence, knowing you have done absolutely everything you can to provide the seller with a price or price range that could be supported by the market.

A "comparable" is a similar home or property which has sold recently in a similar area. However, in many areas, the market is much faster-paced than it was just a few months ago, with shorter days-on-market numbers, and with limited inventory, some areas either just don't have that many sales or don't have any comparable properties.

Or sometimes, the property is so unique, there is just nothing that compares to it.

When I was an agent, I had a number of sellers in similar situations. One seller in particular called me one day to list her home. It was a beautiful home. Gorgeous! High end finishes on a stunning piece of property. There wasn't anything in the neighborhood that could touch it in terms of quality.

If that wasn't bad enough, all the neighborhood comps I had to compare the home to were from a full eight months previous. The market had shifted in the last six months to a much faster-paced market and prices had appreciated at a faster pace than usual. I knew it, but it wasn't until I moved my focus out further to adjacent neighborhoods that I could see how much they had appreciated, measure the appreciation, and apply that to the subject property.

Because homes had appreciated and I knew how fast they were selling, I priced the home aggressively and - sure enough - received multiple offers. The seller was thrilled with the result. But we wouldn't have arrived at that result if I didn't get creative and determine how else I could arrive at a market price without comparables.

Even when you do have some comparables, you can usually attain more by adjusting your focus to include more area - or more time. In my case above, since I couldn't tell what the market was doing at the focused-in neighborhood level, I made my view broader to include additional neighborhoods. As an agent, I would also make my view broader to include more time (go back not just 90 days but six months or more for comps).

When you have no comparables, you must take out your measuring stick and ask, "What can I measure with this?" And while there isn't a single measurement you can rely on in every situation, you can use these to compare against each other to "check your work".

Here are five tools I have as a backup when a traditional comperable won't do the job.

#1 Price Per Square Foot Comparison

In this document, I would not only measure the price per square foot of properties that did sell, I would also measure recent expireds. Sometimes the data from recent expireds can be just as telling - if not more so - than what actually sold.

#2 Historical Records of Sales & Appreciation

Sometimes it pays to look back in history at appreciation, not just what a property sold for. For example, say you have the following properties and the subject property in a neighborhood which all sold for around the same price at around the same time:

Last sale date Price Most recent sale date Price Appreciation Property 1 10/3/2003 $251,950 8/31/2012 $324,660 28.85% Property 2 7/25/2003 $274,000 4/30/2012 $350,000 27.74% Property 3 1/26/2004 $305,000 12/15/2012 $398,000 30.49% Average appreciation 29.03% Subject property 12/20/2003 $257,000 If Subject Property appreciated at this same average rate, the result would be about $330,000. #3 Market Predictor Using Assessed Values

I love this tool because not only is a good one to have in your back pocket for situations such as these, but it also works wonders for explaining to homeowners why the market value of their property does not match the assessed value.With this tool, assessed values of recently sold properties are compared against their final sales price. From this data, a ratio is created which can then be applied to the subject property.For example:

Assessed Value Sale Price Ratio Property 1 $207,000 $251,950 1.22 Property 2 $201,000 $274,000 1.36 Property 3 $219,000 $305,000 1.39 Average ratio: 1.32 Subject property $229,000 Using the assessed value analysis: $302,280 #4 Comparing Amenities

Instead of trying to look at whole properties in specific neighborhoods during a specific time period, try instead to look at just the neighborhood, or just the style of home (such as single-story, split level, or homes with a daylight basement), or even at lot size or an interesting feature such as homes with two master suites.

#5 Listing-to-Pending Ratios

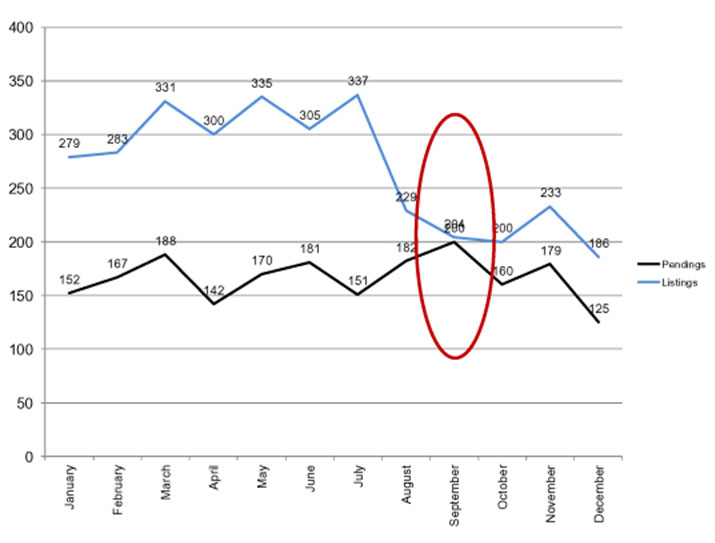

This is my personal favorite. In order to get a snapshot of just how fast the market is moving (and track supply versus demand), as an agent I would track the total inventory and how much of that was "removed" from the available inventory each week with a pending. So if you have 100 homes on the market and 39 of them pend, you have a 39% listing to pending ratio.

See the chart below. When the inventory and pendings lines get closer together, this represents moving towards a seller's market with low inventory and high demand. When the lines move further apart, this signifies a buyer's market with high inventory and low demand.

I can use this when pricing property by seeing what the demand is on a whole for specific types of properties: in a particular area, in a particular price range, or a particular style of home or amenity.

This way I can look at the pulse of the market now versus the pulse of the market from when my comparables were sold, giving me a better idea of how I should price.

Don't be worried if there are no comparables that appear to be a good match to your subject property. Learn a few new tools and don't be afraid to get creative!

If you are faced with the daunting task of pricing with few comparables in your market and would like to fill your pricing toolbox, check out our Pricing System version 2.0! It is chock-full of the tools you need to price property in any market.

By Denise Lones CSP, M.I.R.M., CDEI - The founding partner of The Lones Group, Denise Lones, brings nearly three decades of experience in the real estate industry. With agent/broker coaching, expertise in branding, lead generation, strategic marketing, business analysis, new home project planning, product development, Denise is nationally recognized as the source for all things real estate. With a passion for improvement, Denise has helped thousands of real estate agents, brokers, and managers build their business to unprecedented levels of success, while helping them maintain balance and quality of life.

Comments(2)