Visit Our Daily Blog at www.wealthwithmortgage.com!

You’re Not The Only One

It’s not uncommon to be a property investor and be ‘unsure’ of what market rent is. Honestly, market rents can change as quickly as our housing market changes. I’ll let you process how crazy that could be….

When deciding how much to charge for rent, most investors are trying to weight out two (painfully obvious) concerns:

- What is the most rent that I can get out of this property each month to maximize my cash flow?

- What amount of rent will keep my property occupied with a good tenant that won’t leave for a ‘better deal’.

Yea, there are many other questions going through an investors mind. The main obstacle though is finding a happy medium between maximizing cash flow but also keeping the property rented out to a good tenant.

Where Can You Go?

Believe it or not, there are a lot of resources online where you can do your ’shopping’ for comparable rents. I’ve found one in specific I’ll recommend:

Rent-O-Meter - This is a website designed to collect information while you’re searching for information. It’s been a great resource for myself and other investors I work with. I’ve also found it to be extremely point on in my market (I can’t say anything for others.. because I don’t rent outside of my market).

You’ll need the following information to get the comparable rents:

- Property Address

- Property City & State or Zip Code

- Current Monthly Rent (What You’re Charging/Thinking of Charging)

- How Many Bedrooms?

- Units in Building (In case it’s an apartment complex)

From there, you’ll get your results.

What Do You Get?

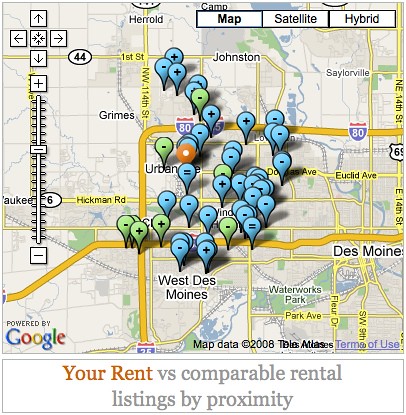

- You’ll get a map of the rental properties being used to give you a comparable rent schedule.

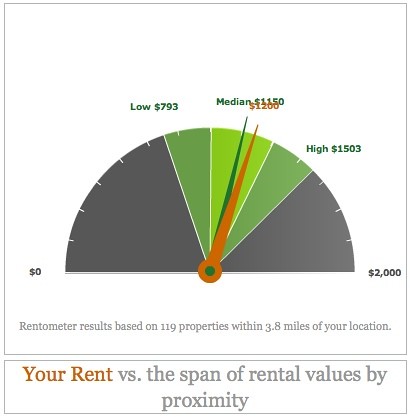

- You’ll see a scale of the rents. Low-Medium-High. The needle represents where you lie in that scale.

Here are examples:

There Are Other Choices

Although I’ve come to really like Rent-O-Meter, I’ve also found success with other techniques. Here are a few other favorites:

- Calling other property management companies in the neighborhood.

- Looking on Craigslist.org to see what else is for rent and what they’re looking to rent places out for.

- Newspaper advertisements.

- Contacting local Realtors that have experience with investment real estate (I can connect you to someone on this one).

- Contacting appraisers in town that may have experience inspecting investment properties (they have to do a comparable rent schedule on an investment property appraisal).

- Join a local property investor association and ask around.

Make Educated Decisions

It’s not always easy to be an investor. However, with the right people and resources - it can be a pretty fun business to be a part of. Me and my team are always available for questions and if you need connected with someone, we can always help with that too!

As long as you take the time to examine what’s taking place in your local market, you’ll be able to make smart decisions and really avoid the ‘riskiness’ of real estate investment. At this point, hopefully it will be a simple calculated risk and you can move forward!

Comments(1)