The real estate market in Sevier County has unquestionably been impacted by foreclosures and short sales of cabins. A large portion of the cabin sales, approximately 40%, have been either foreclosures or short sales. Among these foreclosures many were purchased at what I would consider bargains and some others were more along the lines of a typical selling price. It is vitally important to ensure the cabin is appropriately priced for a foreclosure before making an offer. I have seen some foreclosure cabins that are priced no more competitive than regular sales, yet have sold quickly on the market. I think part of this is attributed to when someone sees "foreclosure" they automatically assume it is a good deal. While this is often the case, it is not necessarily always true.

The majority of foreclosures are centered in a few developments. Notably, those that were developed in the 2005 to 2007 time frame when the "building boom" was happening in Sevier County. Prior to 2005 the number of cabins in the area was not sufficient to accomodate the numbers of visitors to the area and people looking to rent a cabin. When 2005 rolled around and several large developments were created the supply versus demand changed and did a 180 degree turn. Each of these developments had somewhere between 100 and 400 cabins and these cabins ended up stealing away much of the market share of visitors. They were after all, new and had the amenities and lavish furnishings that visitors desire. This caused the older cabins to see a dramatic drop in their rental revenues. While many of the owners of the new cabins did in fact see good rental histories, they also paid outrageously high prices for the cabins and made it difficult to sustain a positive cash flow. Especially considering the utility costs, taxes, home owners insurance, and HOA fees within the development.

The developments with the largest number of foreclosures and short sales are listed below. Most of these all have a common denominator of being developed in the 2005 to 2007 time frame and are PUD's (Planned Unit Developments) with the cabins "stacked on top of each other". The exceptions to this rule are Sky Harbor and Chalet Village. Both of these developments are experiencing a high rate of foreclosure. This can be attributed to them both being older developments with some properties that are dated and not producing the same level of income they once generated. Also, they are both massive in size with over 1,000 lots each, so there are going to be foreclosures in the developments even in good times. For the most part, both developments feature entry level cabins where some smaller investors/owners "dipped their toes in the water" and ended up finding the water was much deeper than they thought and could handle.

Developments in the Smoky Mountains with the most Foreclosures

- Alpine Mountain Village - Pigeon Forge

- Bear Creek Crossing - Pigeon Forge/Sevierville Area

- Black Bear Ridge Resort - Pigeon Forge

- Brothers Cove - Waldens Creek area

- Chalet Village - Gatlinburg

- Covered Bridge Resort - Pigeon Forge/Waldens Creek area

- Hidden Springs Resort - Pigeon Forge

- Mountain Shadows Resort - Gatlinburg

- Settlers Ridge - Gatlinburg

- Sherwood Forest Resort - Pigeon Forge

- Sky Harbor - Gatlinburg/Pigeon Forge Area

While there are several other developments that have foreclosures, they are more of a case by case basis. The most difficult type of foreclosure to find is a cabin located on acreage that has been foreclosed. They are in high demand and there is very little selection of quality cabins on acreage within our MLS, let alone foreclosure cabins. Prices of foreclosures are typically around 60% to 70% of the original selling price of a cabin. This can vary dramatically depending on the development and how hard it has been hit by foreclosures and how much the owners "overpaid" for the cabins in the first place. For example, I just sold to one of my clients a 6 bedroom, 6.5 bath foreclosure cabin in Black Bear Ridge Resort for $295,000 that originally sold for $760,000. The original selling price included furniture, while the $295,000 did not, but still it was purchased at 38.8% of the original selling price and approximately $63 per square foot! With these numbers there is no doubt in my mind they will be receiving a good positive cash flow.

Prices of foreclosures are typically around 60% to 70% of the original selling price of a cabin. This can vary dramatically depending on the development and how hard it has been hit by foreclosures and how much the owners "overpaid" for the cabins in the first place. For example, I just sold to one of my clients a 6 bedroom, 6.5 bath foreclosure cabin in Black Bear Ridge Resort for $295,000 that originally sold for $760,000. The original selling price included furniture, while the $295,000 did not, but still it was purchased at 38.8% of the original selling price and approximately $63 per square foot! With these numbers there is no doubt in my mind they will be receiving a good positive cash flow.

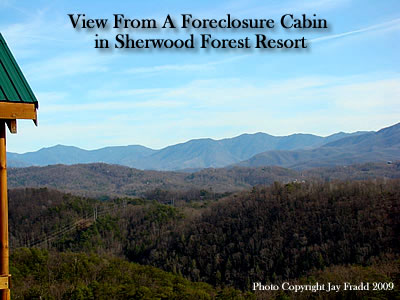

Other properties have come up in the market that are unquestionably good deals. For instance, there was a cabin in Sherwood Forest Resort that originally sold for $370,000 (furnished) that had a listing price of $129,900. This cabin was originally listed at $189,900 and once the listing agent had the large $60,000 price drop it immediately received a lot of activity and multiple offers. The cabin is 1,560 square feet with 2 bedrooms and 2 baths with a spectacular view of the Smoky Mountains. Comparable properties in the development have gross rental incomes of between $35,000 and $40,000 conservatively. The amenities of the development are attractive to visitors - with the gated entry, community swimming pool, large conference center/lodge, and absolutely stunning mountain views.

Other properties have come up in the market that are unquestionably good deals. For instance, there was a cabin in Sherwood Forest Resort that originally sold for $370,000 (furnished) that had a listing price of $129,900. This cabin was originally listed at $189,900 and once the listing agent had the large $60,000 price drop it immediately received a lot of activity and multiple offers. The cabin is 1,560 square feet with 2 bedrooms and 2 baths with a spectacular view of the Smoky Mountains. Comparable properties in the development have gross rental incomes of between $35,000 and $40,000 conservatively. The amenities of the development are attractive to visitors - with the gated entry, community swimming pool, large conference center/lodge, and absolutely stunning mountain views.

It is a good opportunity now for investors to purchase certain foreclosed cabins in the area. I feel most of the cabin prices still have some adjustment downward because they do not create a positive cash flow. There are definitely properties out there though that perform well and I do my very best to locate those properties. My website has a foreclosure page that I update daily with all of the new foreclosures on the market and price changes of the properties. It is a good resource to use to help identify some of the better priced cabins available. While not all of the cabins listed as foreclosures and short sales are great deals, several are.

Comments (5)Subscribe to CommentsComment