A popular advertising hook used by mortgage lenders is the concept of a "no points" loan. Another variation of this type of loan is a "no cost" loan. Many people who begin the refinance transaction will say "I don't want to pay any points" as an immediate reaction when talking to a mortgage originator. Their defense mechanism that makes them feel in control of the process and isn't going to get ripped off. In fact, sometimes it makes sense to pay points - sometimes it doesn't. Today we'll look at the no cost-type loans and give you the inside scoop on how they work.

The difference between no points and no cost

No points - This means that you are not paying any loan origination points to the mortgage originator for their service out of your closing costs. For example if you have a $100,000 loan and are charged a point (1% of the loan amount) you will be charged $1,000 as a mortgage origination fee. If you have a no point's loan you will not pay that point up front - you will not be charged $1,000 in origination fees.

You will still be charged for other fees associated with your mortgage; and these fees will come out of your upfront closing costs. Fees that are not covered by a no points loan can include:

•· appraisal fee

•· title and escrow fee

•· processing fee

•· underwriting fee

•· administration fee

•· document prep fee

•· recording fee

•· notary fee

These fees will be charged on your final settlement as up front closing costs. If you request a no points loan do not be surprised to see charges such as the above on your settlement statement.

No cost - With a no cost loan the fees that are listed above are covered by the mortgage originator and are not part of your up front closing costs. On this loan there are no points charged and there are no fees charged to you as closing costs. There are a couple of variations on the no cost loan.

No cost from the originator - this is where there are no costs associated with the origination of the loan but third party fees such as title and escrow are still payable.

A true no cost - this is where there aren't any costs charged to you either from the originator or from third party companies involved in the closing of your loan.

Note: There may still be some costs charged to you on this type of loan. Charges from your previous mortgage holder such as a prepayment penalty or payoff fees will be charged. Impound accounts (if you've requested them) for your taxes and insurance will still be withheld from your loan proceeds.

There has to be a catch - how do originators make money on these loans?

That is a great next question! There is a bit of a catch to these no cost loans. It helps to remember that you make a living because someone pays you to deliver a service. Whether it's answering the phones or writing prescriptions everyone is paid for their time and expertise that they bring to their job. Mortgage originators are no different. Home lending is not charity; nor should you expect it to be. In fact you want your originator to make some money on your loan; that way they'll be vested in the successful completion of your file.

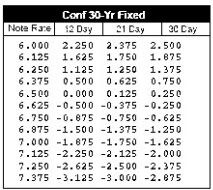

So how again do mortgage originators make money on no cost loans? The first thing to realize is that there is no one interest rate available. Mortgage originators have the option of selling you varying interest rates based on what the bank is offering for a given product. Take a look at the rate sheet on the right for the rates on a Conforming 30-year fixed mortgage.

How do I read this thing?

The rates are in the 1st column. The next columns 12, 21, 30 Day are the lock terms that are available for the loan. This is the duration of time that the rate is guaranteed for once it is locked by the investor.

The rates are in the 1st column. The next columns 12, 21, 30 Day are the lock terms that are available for the loan. This is the duration of time that the rate is guaranteed for once it is locked by the investor.

The numbers are the cost of the loan to the originator from the bank. When the cost is zero (0.00) there is no cost to the originator from the bank for that interest rate. This is called the par rate. Negative numbers mean that the bank is paying the originator a rebate (expressed in points) for that rate. A rebate is simply cash for selling an interest rate above par. Positive numbers are the points that the bank would charge the originator (and ultimately you) for acquiring that rate. These points are called buy-down points.

The higher the rate the more the bank pays the originator. Look at the above rate sheet. On a 30-day lock 7.375 pays the originator 2.875 points. So the bank will pay the originator 2.875 points for selling you the loan at 7.375. On a $100,000 loan the bank pays $2,875 to the originator.

So that is the answer to how originators get paid on a no cost loan. The bank pays them.

Where's the no cost in that?

The originator then uses some of the proceeds from the bank payout for the loan to cover the cost for the fees listed above as well as their origination charges. For this example assume that the closing costs on the $100,000 listed above cost $1,875 (or 1.875 points) after those expenses are paid with proceeds from the bank, the originator is compensated 1 point (or $1,000) for his work. In this way the originator is able to offer you a no cost loan.

What does this mean to me?

Let's say that you chose to pay 1 point in origination fees along with the costs associated with the loan (mentioned above) so that you were able to get the par rate on your loan. Par, on a 30-day lock, works out to 6.625 (the closest to zero). Let's look at the difference in monthly payment:

Your monthly payment on $100,000 at 7.375 is $690.68.

Your monthly payment on $100,000 at 6.625 is $640.31.

That's a monthly difference of $50.37. You can see how this would quickly escalate for a larger loan size, say $300,000. The difference in payment would be $151.10 each month.

The difference in interest rate for a no cost loan can add up to significant dollars over the life of the loan. In the above example if you kept the loan for the full 30 years you would pay an additional $18,133.20 in payments by choosing the no cost loan compared to paying $1,875 in up front points and costs. Not a very good trade, in my opinion.

How about a more realistic example? If you keep the loan for 10 years you pay an extra $6,044.40 in payments compared to $1,875 in up front points and costs. Again, not a very good deal.

When does it make sense to pay points or choose a no cost loan?

The key to deciding when to choose a no cost loan is determining how long you are going to keep the loan. In the above example if we were only keeping the loan for 2 years before refinancing or selling the home then we are making an extra $1,208.88 in payments compared to $1,875 in up front closing costs. Now a no cost loan makes much more sense - and is actually saving us money. $666.12 to be exact.

The general rule of thumb is the shorter time period you plan to keep your loan the more a no cost loan makes sense.

The Break-Even Point

The general concept here is the idea of the break-even point in your mortgage. The break-even point is the point where you've recouped the fees and expenses associated with your refinance through the monthly savings recognized with your new loan. To determine the break-even point, take the monthly savings of one option over the other (in this case the $50.37 in monthly payment savings) and divide it in to the cost of doing the loan ($1,875). This gives you the number of months needed to break-even: 37.22.

In the above example the break-even point occurs at 37 months - or just after 3 years of holding the loan.

If you plan on staying in the loan longer than 3 years it makes more sense to pay the closing costs ($1,875) up front compared to taking the no cost loan. If you plan on being in the loan less than 3 years it makes more sense to take the no cost option. You should calculate the break-even point for all refinance transactions you consider.

Other considerations

There are other considerations such as the time-value of money and opportunity costs that factor in to whether to pay up-front points or fees on a loan. They come more in to play when you are talking about bringing cash to closing at a purchase opposed to using equity in your home to pay for the up front closing costs in a refinance. We'll talk more about those in a future post.

Conclusion

The no cost loan is an attractive advertising hook; but as with everything else regarding your home loan you need to consider your specific situation and what you need before making a catchy advertising gimmick your financial plan. Remember: the shorter you plan on holding the loan, the less it makes sense to pay points and fees. The reverse is also true.

Always calculate the break-even point when considering options for refinancing to ensure you're maximizing the value of the transaction. Talk to a trusted mortgage originator who will take the time to run break-even analysis for you on various scenarios to find the best mortgage for your situation.

Comments(0)