Are You In for a Trick or Treat?

Learn What Remains for Those Seeking a Home or Loan

|

The last weekend in October you were likely treated to a host of Halloween characters, all in search of treats, not tricks. People searching for a new home or a mortgage, whether they donned a costume or not, may have gotten a little of both.

Home loan seekers have been treated to great rates all year long since the Federal Reserve announced it would be purchasing mortgage backed securities, with rates diving below 6.00% since last December. However, if you are looking to buy a home, according to the Case-Shiller index, home prices increased for the fourth straight month, possibly signaling the end to home price declines. So, the question now is what lies ahead?

How About a Little Perspective?

Applications for home loans fell the last few weeks of October as average reported rates for a 30 year fixed rate climbed above 5.00% according to both the Mortgage Bankers Association of America and Freddie Mac. The reason most cited for the decline in applications was increasing rates. Which means that for many people a rate above 5.00% was the cause for a decline in applications.

Perhaps this could be for one of two reasons. The first could be that anyone who could refinance into a sub-5.00% rate had already done so. The second is that people could be thinking that either rates will fall below 5.00% again or that rates in the low 5.00% range are simply not that attractive.

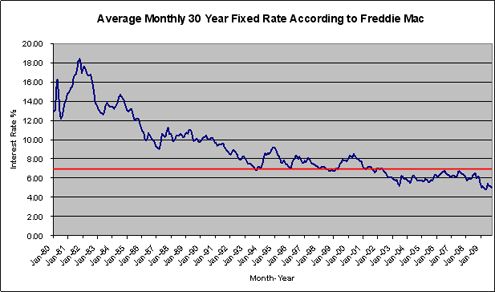

If we were to take a look at home loan rates dating back to 1980, a span of nearly 30 years, the average monthly reported rate for a 30 Year Fixed Rate loan according to Freddie Mac was 9.07%. While the thought of a rate in the 9.0% range seems exorbitant today, today's rates were inconceivable prior to 2001...and especially in October 1981 when rates were a whopping 18.45%!

The chart below shows the average reported monthly interest rates since January 1980. This graph does not take into account the amounts paid to obtain these rates, which were as high as 2.6% in 1984, compared to 0.7% in 2009. The red line represents 7.00%, showing that rates below 7.00% were an abnormality prior to 2002.

The low rates we have seen this decade are largely attributable to the impact of the 9/11 bombing which launched global economies into a tailspin. The result was an aggressive lowering of rates from the Federal Reserve to stabilize the economy. The impact of low interest rates resulted in a rapidly and unsustainable appreciation in property values.

As property values started their return to "normal" we witnessed the plunge into our current recession. We also saw the Federal Reserve get into the mortgage backed securities (MBS) market, becoming the major buyer of MBS this year, driving rates to current and lower levels.

While rates may appear a little less attractive based on where they have been this year, do not let that cloud your judgment. Any home loan rate with a five as the first number followed by a decimal point is a fantastic rate, when all things are considered.

Just as Halloween Has Passed, So Will These Rates

In short, as the Federal Reserve begins to pull back their purchase of MBS, as was started in October, mortgage rates will rise. It is not inconceivable to believe we will see interest rates well above 6.00% at some point in 2010, in particular after March as the Fed is scheduled to wrap up its MBS purchase program on March 31, 2010. Regardless of where we have been, for those wanting a phenomenally low interest rate, acting sooner rather than later is the best decision.

Try These Numbers on for Size

For comparison sake, just to offer a little more perspective, if one were to look at borrowing $150,000 for 30 years, here are some principal and interest payments to consider. A rate of 5.25% would yield a monthly principal and interest payment of $828. The average interest rate of 9.07% since January of 1980 would yield a payment of $1,214 or nearly $400 higher. The highest interest rate of 18.45%, in effect in October 1981, would require a payment of $2,316, a whopping $1,488 a month more. Viewed from a different perspective, one could borrow $417,000 at 5.25% for $13 less a month.

Yes, admit it. We have become spoiled with the best home loan rates we have ever seen. Sure, everyone would love a 30 year fixed rate that starts with the number four. However, do not let rates off their lows deter you from making a decision that could save you thousands of dollars over the time you may have your next loan in effect.

What about Home Prices?

There is no shortage of data one can choose from to base an argument for whether or not home prices have bottomed. One thing is clear though; national data is only relevant for determining overall trends, not local realities. That said, the S&P Case-Shiller index is widely touted as an accurate assessment on both national and local levels for the areas they report on.

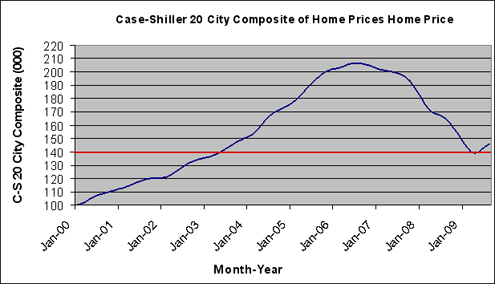

Indexed to 100 in January 2000, it is easy to see when home prices began their rise and how they became out of sorts with where they should have been. It's also easy to determine when home prices started their decline in mid-2006.

The chart below, showing a 20 city composite of home prices, also demonstrates what many like to point to in order to demonstrate that home prices have bottomed and are on their way to stabilization and appreciation. The last four months have each marked an increase in month over previous month comparisons; although still lower than the 12 month previous number that is often used for comparison.

The red line indicates the point that many are referencing as the bottom of home prices. Whether you are a buyer looking to take advantage of prices not seen since 2003 or a homeowner looking to refinance, this point of reference could be the trigger you need to make a decision to move forward. No one wants to pay more for a home than they could have and increasing values hopefully will make it possible for more people to rid themselves of higher priced loans.

Whether housing has made a bottom or not, first time home buyers (FTHB) have voted with their wallet, showing that home prices overall are now affordable and they have been buying en masse. Washington and the IRS, FTHBs have accounted for monthly sales volume as high as 50% or more of total sales this year.

What Now?

Whether you are looking to refinance or purchase a home, the best way to determine what you may be eligible for is to speak with a professional. They can assess your situation and help you make a decision that is in your best interest.

However, in order to make the best decision and take advantage of rates that historically will be viewed as the lowest we may see in our lifetime, sooner is better than later to pick up the phone. Regardless of what happens to home prices, we do know that interest rates are on the rise. The Federal Reserve will end their program for purchasing MBS next March putting pressure on home loan rates to rise.

Go on, pick up the phone, call your mortgage professional and say "Trick or Treat!" Sure, you might be a little late according to the holiday calendar but you just might find something to be thankful for.

Karl Peidl

Loan Officer

Pleasant Valley Home Mortgage Corp.

305 Harper Drive

Suite 3

Moorestown, NJ 08057

856-252-1200 x1224

856-252-1240 (fax)

877-296-5454 (toll free)

Comments(0)