Recap of Denver Fourth Quarter 2007 Home Price Performance

The average home price in Metro Denver increased +2% in the full year 2005 to the full year 2006, from $309,000 to $317,000.

Comparing 2006 to 2007, the average home price across the metro dropped 2%, from $311,000. The average price of a foreclosure or short sale dropped in that time period -3% to $188,000. The average price of a non-distress sale increased 5% to $370,000. Sales volume over the last twelve months is off -4% for DSF/ASF. Foreclosure and short sale volume is up +31%; non-distress seller volume is off 20%. If you handle a lot of listing and the market seems slow, this is likely the reason why.

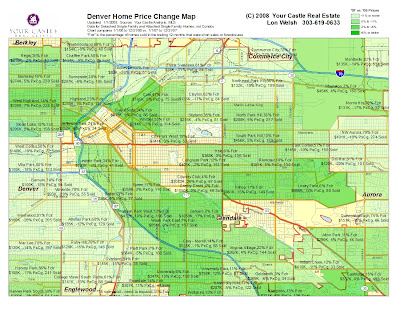

Some areas did better than others. The attached chart shows different neighborhoods in Denver County (email me for a larger version). Each region has the neighborhood's name and the percentage of sales in the last twelve months that were either short sales or bank-owned properties. The second line has the price change the twelve months from 2006 vs. 2007. Next, you'll see the average home price in the last twelve months and the number of homes that were sold.

There had to be at least fifteen sales in the last year for an area to be included. The numbers are more reliable in areas where there were more sales. For example, Wash Park West had 196 sales -the numbers are likely to be very reliable. In Lincoln Park, with only 41 sales, the numbers are more likely directional.

Less expensive areas generally didn't do as well. For example, Westwood (average home price $100K) saw a 20% drop in prices. More expensive areas generally did better. For example, Hilltop (average home price $961,000) was up 15%. 81% of the sales in the Westwood area were related to foreclosures, where in Hilltop, only 11% were foreclosures (up from 9% last quarter). There's a pretty strong relationship; where home prices are less expensive, there is more of a foreclosure problem, and that tends to drag down the prices. Another factor driving home price appreciation in some upscale neighborhoods are re-sales of recently scraped properties, where a small, run down $300,000 home is replaced with a new home at $1,000,000.

Source: Your Castle Real Estate analysis, MLS data

(c) Copyright Your Castle Real Estate, 2007

Comments(0)