I ran across this great article by Boston Appraisal Services. I hope you all enjoy it as much as I did. I'd be interested in the thoughts of those appraisers here in AR. Appraisers are an integral part of all Real Estate transactions.

The backbone of any real estate appraisal is the highest and best use analysis. All properties have a highest and best use – and this is not always the current use. There are four qualifiers that help to determine the highest and best use of a property. The use of a property must be…

- Legally Permissible

- Physically Possible

- Financially Feasible

- Most Productive

The goal of the real estate appraiser is to identify the use of the property that will be the absolutely most profitable use within legal, physical, and financial boundaries. Property owners are often blinded by the current use of the property, and they fail to see that a change in use could be more profitable. This is where a real estate appraiser can help.

Real estate that has a more valuable future use is called a transitional property. A transitional property may respond to an immediate use change or the most profitable use may come after the passage of some time, as would be the case with a future zoning change.

Traditional properties are true diamonds in the rough. A savvy real estate investor often sees developmental value in grandma’s old farmhouse when the children only see stinky cows and chipped paint.

When a real estate appraiser is working for an owner/client, they will be able to help the owner to see the true developmental potential of their property to maximize a future sale price. When an appraiser is working for a purchase/developer/client, they can project the actual, or even future, market value of a property after its transition into a new use. This can justify a purchase price or be used as a basis to seek third-party funding for development.

Let’s examine each of these four highest and best use qualifiers to see how they can shift a property from their current use into a more valuable future use.

Legally Permissible

Transitional properties are commonly created when the zoning is changed. Properties that used to be strictly residential may now be approved for multi-family use. Land that was multi-family could be changed to office/service or retail/commercial. Once a new zoning designation is applied to the property, it becomes legally permissible to transition to another use.

In some cases, an existing zoning designation may allow for a change in use. For example, an R2 zoning may allow for two-to-four family dwellings. Could the existing single-family home be converted into a duplex? Could the storage warehouse be converted into a retail store?

In other cases, a change of zoning particular to that property could create a more profitable use. For example, a residential property may be located adjacent to an office/service zoning. It has been determined that the house could be easily converted into an office, so the property owner files with the local zoning authority requesting a change in zoning. Perhaps you have seen real estate offices, attorneys, counselors, or even dentists set up shop in what was clearly someone’s home in the past.

Physically Possible

Before any other qualifier can be analyzed, the legal uses of the property must be established. Once that is determined, the next step is to look at if a change of use is physically possible. In many instances, the existing structure could be converted to a new use. A home could be changed into apartments or an office, a warehouse into light industrial or retail. The changes to an existing building are almost endless – as long as they are physically possible.

Financially Feasible

But in the end, it does really come down to the cost. If it will cost $40,000 to convert a house into a duplex but the market value of the property will only increase $20,000, or in some cases may lower the value, then just because it is legally permissible and physically possible it is not financially feasible and thus not the best use of the property.

Now, on the other hand, there comes a time in a property’s life where the structure may create a negative drag on the value. For example, there was this 1,200 square foot quaint turn-of-the-century cottage with 150 feet of frontage on a very beautiful inland lake. The land was selling for $1,000 per front foot. The home had a depreciated value of about $40,000. A buyer would most likely tear down the house, remove any site improvements, and start over by building a multi-million-dollar home on the land. The demolition cost was estimated at $35,000. The appraiser estimated that if the property sold with the house, the market value would be $1,465,000, and if vacant, $1,500,000. The owner decided to sell first the house for $10,000 you-haul and then listed the now vacant property for $1,500,000 earning $45,000 more than if he listed the property “As Is” with the house.

Most Productive

The fourth qualifier is establishing all legal uses that would be physically possible and financially feasible the appraiser would need to make sure the use is also the most productive. In other words, what would be the most productive use of the land that would give the highest return.

In some cases, the best use of the land is in its division. This is often the case with smaller parcels of farmland that are just outside a residential area. Development into a subdivision rather than its continued single-family use is usually always more profitable.

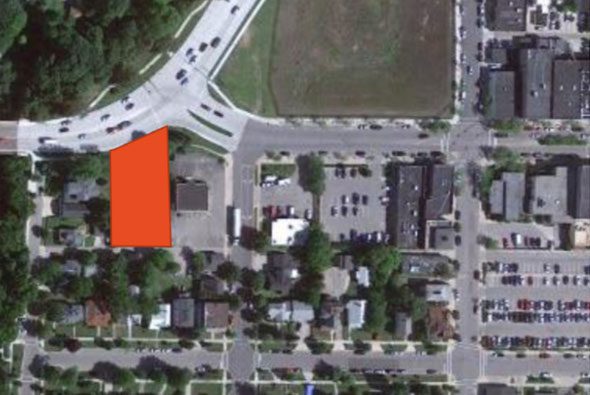

In other cases, joining several adjacent smaller parcels together will create a higher value than if purchased individually. For example, an area near a highway was recently rezoned from multi-family to commercial. A developer, seeing the transitional use potential, bought three old run-down rentals all next to each other. After demolishing the buildings and assembling the land into one parcel, he sold the property to a commercial developer for 50% more than what he paid. While each of the three residential lots were originally valued at $15,000, as a commercially zoned larger vacant parcel it had a value of $125,000. A true diamond in the rough.

Transitional properties are what developers live for. There is money to be made if you can see past what is and envision what it could be. Your local appraiser would be more than happy to help you determine what would be the highest and best use if you ever discover one of these hidden gems.

Comments(14)