It's been about a year since the meltdown on Wall Street, and it's good to hear that Ben Bernanke thinks the recession is over.

I believe that much has been done, and that the steps taken have been positive, but it's not over by a long shot. Yes, necessary things have been done to stabilize the economy so that we are now just in a recession as opposed to the "Great Recession", and it appears that what has been done by governmental design is to shore up, capitalize, and stabilize the banking system. Although that has left distaste in the mouths of many, it seems to have been a baby and bathwater bailout.

Nevertheless, let's not kid ourselves, the fundamentals that led to the "Great Recession" are still with us, and the statistics that are giving us hope are somewhat misleading at the present time.

Specifically, the fact that foreclosure rates have declined is a skewed statistic. Loans are not being modified in large part, and short-sales are difficult and very lengthy procedures. The major banks have merely put off foreclosures en-masse for several reasons.

There was the Land Court decision in Massachusetts that tossed out foreclosures because the banks were backdating signatures, and this led to title insurers becoming skittish about insuring foreclosure sales; political pressure caused banks to delay foreclosures and implement homeowner retention programs (just a delay tactic).

Moreover, banks have a financial impetus to not declare chunks of balance sheet debt as being uncollectible when the market might improve and those debts could begin performing better, or be sold at better rates.

There is speculation that in the coming months there are literally millions of foreclosures that are in the pipeline, and when these hit the marketplace the statistics will be more in line with the reality.

Although unemployment has stabilized in that we are not seeing the massive increases in layoffs that we have been seeing for the past year, there is around 10% unemployment; an unknown number of underemployment, and those not reporting because they can no longer collect benefits, or they are doing something else, like starting a new business. All in all, these lost jobs have not been able to be replaced and the job creation process will take some time. All of this is causing even previously good credit risk consumers to default, and others to clam up on their spending.

The residential housing market is mostly seeing buyers in the first-time homebuyer category due to the $8,000 tax credit, which will most likely be extended, but will inevitably expire sometime next year. There is little ability for existing homeowners to trade up to new, and more expensive homes, as they have lost equity, face tighter underwriting standards, and are not willing to dive into this marketplace, which has put a major damper on those segments of the marketplace.

The commercial real estate market is devastated, and we have not yet seen the wave of defaults in that area, which will most likely occur in the first half of 2010.

So why are the experts saying that the recession over?

Because consumer confidence drives our economy, and if the pundits, experts, and the media do not report on the economy in the dire manner in which they were doing in the early days of this crisis, they will not create a consumer confidence epidemic that will add to the fundamental difficulties that we already have. Thus, people are now uncertain, apprehensive, and careful, but not apoplectic, and that is a big help to the economy.

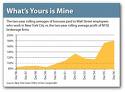

Wall Streeters are still making money and earning large bonuses, and, as counter-intuitive as that may be, I pointed out in my last post that "we need their strength", and that such earnings levels are probably engineered by political design to keep our financial institutions powerful and dominant in the world's markets.

My message is this:

Hey Wall Street, invest your bonuses in distressed real estate!

Realize that you're luckier than smart; you dodged a bullet; and that you are being paid far more than you are truly worth. Take that money and invest in distressed real estate funds. In that way, you can make even more money, but at the same time use the bonuses that you have "earned" to fuel the real estate market and improve the livelihood of others around you, and the communities that we all share.

Think about it.

Comments(1)