| Real Estate Market Overview | |

|

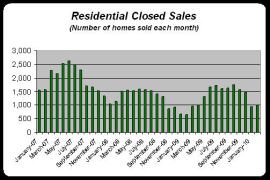

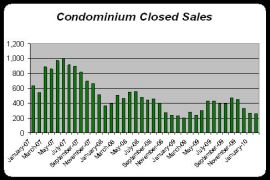

Our Greater Seattle residential real estate market is continuing to look solid on a price basis, and is sneaking up on a whole year at essentially the same stable price level. However, the hopeful blip in condominium prices last month didn't hold up, and condo median prices are back to their December level - and have been consistent for that same year now. Inventory is starting its usual seasonal climb, and the level of Closed Sales, i.e. purchase transactions completed, has put in its usual seasonal December/January flat bottom, but at a much higher level than last year's dismal beginning levels. Closed sales levels for single family homes are back to 2-years-ago levels, but condominium sales levels have not yet recovered, and are still running about 30% below early '08 levels. As noted last month, some buying clearly has been stimulated by the federal Homebuyer Tax Credits. Here's a link to a quick overview of the current tax credit incentives for homebuyers - both first-time buyers and move up/downsize/move around buyers and investors.

|

| Current Market Statistics | |

|

The links below provide a graphical summary of Real Estate Market Statistics for the Greater Seattle / Bellevue / King County area over the most recent 3+ years, for single-family homes and for condominiums. As noted above, median prices seem to be holding steady, and the number of single family homes available is staying well below 2008 and 2009 levels. However, condominium inventory appears to be climbing more rapidly and is a bit above 2008/2009 levels. This may be caused by builders putting more of their condominium inventory on the MLS rather than just holding it for direct sales - particularly in downtown Seattle and downtown Bellevue.

Months-Supply has bounced up sharply, for both residential and condominium, as it always does in January. Unfortunately Months Supply this year for condominiums has bounced back up to early-2009 levels. By contrast, Months Supply for single family homes is now nearly 40% below early-2009 levels. That is good, but a bit higher than expected - 8 months supply is still in the balanced market range, but not nearly as good as the 5 months supply we were down to last Fall.

Here's the charts for the current MLS stats through February:

(Required disclaimer: Charts not prepared, reviewed or verified by the Northwest Multiple Listing Service)

Click for Residential Market Charts Click for Condominium Market Charts

Average Days-on-Market continues to run about 80 days for both single family homes and condominiums. That means that the average time-on-market to get a home sold is 80 days - for the homes that do sell, not including the ones that don't sell. If you are a potential seller, and you don't like that 80 day number, you will need to think about what you will have to do to push to the front of the line - some combination of price, condition and marketing. All of our market reports and related articles are posted on our blog, so if you want to go back and check a previous one again, just click here.

|

Comments(0)