Foreclosure Warning: 20% Of All Homeowners Expected To Default | 11 Million At Risk Of Foreclosure

Regardless if you want to call this heightened hype or simply a hard scary reality of things to come, it is important to have such a dialog in an open forum to address such a serious issue that will most definitely affect each and every tax paying homeowner across this country.

Warning: The Blog Post Contains Serious Real Estate Doom and Gloom. Avoid Operating Heavy Machinery and Drinking Alcohol While Consuming This Information.

Harris Real Estate University students live by the mantra, “Hope for the best but, be prepared for the worst”.

That mindset will allow you to be over prepared.

When the bad housing news hits you are not emotionally (or financially) devastated. Get ready, because what you are about to read can only be translated as bad housing news…some of you will be surprised and maybe a little shocked. Please don’t let your emotions get the better of you. Fact is, even in a market like this one there are still huge opportunities.

One of the best opportunities now? Being the agent with the bank foreclosures…as a REO Listing Agent. (and making money now from BPOs). Watch the FREE RSD (REO Specialist Designation) video and download the FREE how-to list REOs book.

Here are the talking points of a new just-released study by Amherst Securities Group.

* Up to 20% of ALL HOMEOWNERS could default….agents, that would mean a 20% foreclosure rate!

* Of all the homeowners who are just 20% upside down its predicted that 75% will default..that equals millions of homes that will become Short Sale listings or eventual REO listings.

* 11.5 million borrowers are in danger of losing their homes. The Obama Administration official Elizabeth Warren has predicted that there could be as many as 18,000,000 foreclosures.

* Amherst calls for: Mandatory principal reductions, looser underwriting of new mortgage loans, leveraged capital pools for investors, and penalties for defaulting homeowners.

* They suggest that borrowers are staying payment free in their homes for an average of 20 months! This study was done BEFORE the whole robo-signer mess came to light. Its realistic to believe that most defaulted owners will stay payment free for 2-3 years. In states like Florida and New York the current time from first missed payment to vacating the property is well over 2 years.

Agents, the last thing someone didn’t pay was their home. Afterall, they needed a place to live. Folks for forgo making car payments, credit card payments…and resorting to eating ramen noodles. Now, they just stop making their house payment. Missing mortgage payments has become upside down owners form of financial stimulus.

* Amherst wants those ‘living free’ to pay up. In the form of their missed payments, taxes and HOAs being treated as regular W2 income. (Good luck with that one fellas)

Amherst predicts over 11 million homeowners will default and lose their home if the government fails to take more radical intervention.

Amherst Securities Group LP, one of the most respected names in mortgage research, has trumpeted an ambitious call-to-government arms in its October mortgage report.

“The death spiral of lower home prices, more borrowers underwater, higher transition rates (to default), more distressed sales and lower home prices must be arrested.”

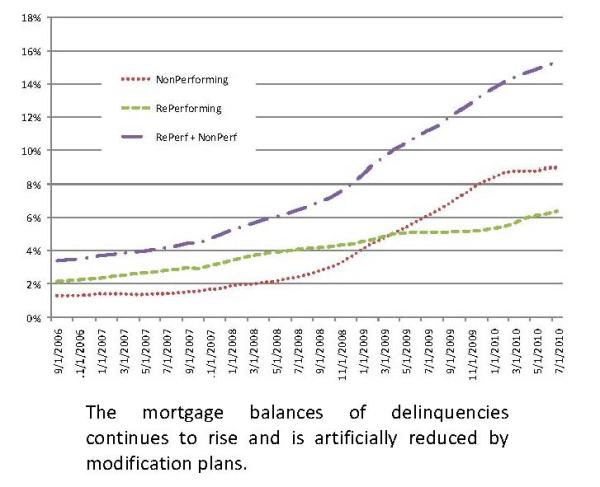

The authors dismiss recent talk of mortgage performance improvement as statistical sleight-of-hand magically conjured by modifications.

“This ‘improvement’ (in mortgage performance) simply reflects large scale modification activity having served to artificially lower the delinquency rate” (Please see the chart above of mortgage balances delinquent and re-performing. All charts in this post are from “Amherst Mortgage Insight” dated October 1, 2010.).

The report offers an astounding forecast of the fate of severe negative-equity properties. Nineteen percent of properties with a loan-to-value (LTV) of 120% or greater are defaulting every year. A death-defying 75% of mortgages on 120% LTV properties will eventually go bad (19% + 19% + 19%, …).

The current crop of mortgages is already “impaired” at the one-of-five level. Nine of 100 are seriously delinquent. Six of 100 are “dirty current” (made current by modification). Five of 100 are seriously underwater (LTV greater than 120%) (Please see the chart above categorizing the forecast of 11 million defaults.).

The authors, who describe current conditions as leading to “an impossible number” of defaults and one that is “politically unfeasible”, unveil a major arms race of measures to counteract the default tide.

The solutions include mandatory principal reductions, looser underwriting of new mortgage loans, leveraged capital pools for investors, and penalties for defaulting homeowners. Amherst reports that a family who defaults can live rent-free for 20 months on average. They propose that missed mortgage payments, including property taxes and insurance, be counted as W2 income.

They make note of recent new signs of distress including two record-low readings of existing home sales in the last two reports. Another block is that underwriting standards have grown much stricter at Fannie and Freddie. Only 2% of Freddie purchases are now bad-credit borrowers where they represented about 20% of borrowers in 2006. FHA purchase mortgages, however, which have by definition much more lenient lending guidelines, have exploded upwards from roughly 10% of their lending in 2006 to more than 50% today.

The buyer pool is also compromised by the fact that 17% of borrowers now have a seriously compromised credit history. After mortgage default a typical wait-time to qualify again is anywhere from 3 to 7 years. One of the more desperate measures suggested by the authors seeks a new mortgage for those who are now behind or in danger of failing. “This (default) can be fixed by re-qualifying borrowers who are in a home they can’t afford into one they can afford.”

Risk is so high in today’s real estate market that private money has largely left the mortgage category. The retreat is most easily seen in the jumbo mortgage market. Total jumbo mortgage origination has fallen from a high of $650 billion in 2003 to $92 billion in 2009 (see the chart above). Government loans account for 90% of current originations.

“If government policy does not change, over 11.5 million borrowers are in danger of losing their homes (1 borrower out of every 5),”‘ the report said, which estimates the total of homes with a first mortgage at 55 million. “Politically, this cannot happen.”

Source: HousingStory.com

Comments(2)