What’s my HOME WORTH in today’s market?

Every homeowner wants to make sure that they maximize their financial reward when selling their home, but how do you guarantee that you receive the maximum value for your house?

Here are two ways to ensure that you get the highest price possible.

1. Price it a Little Low

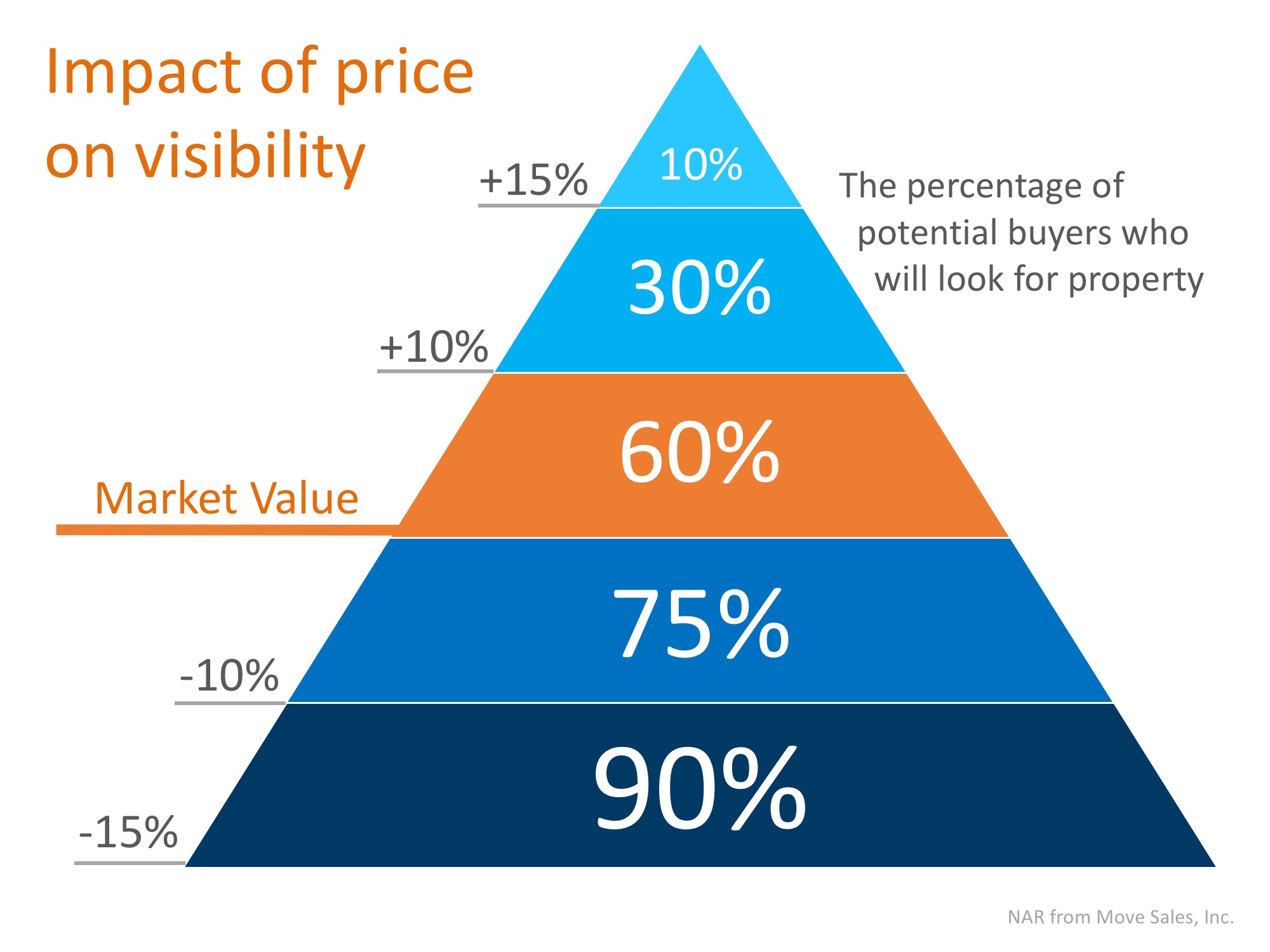

This may seem counterintuitive, but let’s take a look at this concept for a moment. Many homeowners think that pricing their homes a little OVER market value will leave them with room for negotiation when, in actuality, it just dramatically lessens the demand for their houses (see chart below).

Instead of the seller trying to ‘win’ the negotiation with one buyer, they should price their house so that demand for the home is maximized. By doing so, the seller will not be fighting with a buyer over the price but will instead have multiple buyers fighting with each other over the house.

Realtor.com gives this advice:

“Aim to price your property at or just slightly below the going rate. Today’s buyers are highly informed, so if they sense they’re getting a deal, they’re likely to bid up a property that’s slightly underpriced, especially in areas with low inventory.”

2. Use a Real Estate Professional

This, too, may seem counterintuitive as the seller may think that he or she will make more money by avoiding a real estate commission. With this being said, studies have shown that homes typically sell for more money when handled by real estate professionals.

A study by Collateral Analytics, reveals that FSBOs don’t actually save any money, and in some cases may be costing themselves more, by not listing with an agent. The data showed that:

“FSBOs tend to sell for lower prices than comparable home sales, and in many cases below the average differential represented by the prevailing commission rate.”

The results of the study showed that the differential in selling prices for FSBOs, when compared to MLS sales of similar properties, is about 5.5%. Sales in 2017 suggest the average sales price was near 6% lower for FSBO sales of similar properties.

Bottom Line

Price your house at or slightly below the current market value and hire a professional. This will guarantee that you maximize the price you get for your house.

We hope you found this information helpful. Contact us today for all your real estate needs.

What’s my HOME WORTH in today’s market?

Oh, by the way … if you know of someone who would appreciate the level of service I provide, please call me with their name and business number. I’ll be happy to take great care of them.

Keller Williams “Highest in Customer Satisfaction” distinction among sellers and buyers – J.D. Power and Associates

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Comments(1)