What’s my HOME WORTH in today’s market?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment; the higher the rate, the greater the payment will be. That is why it is important to know where rates are headed when deciding to start your home search.

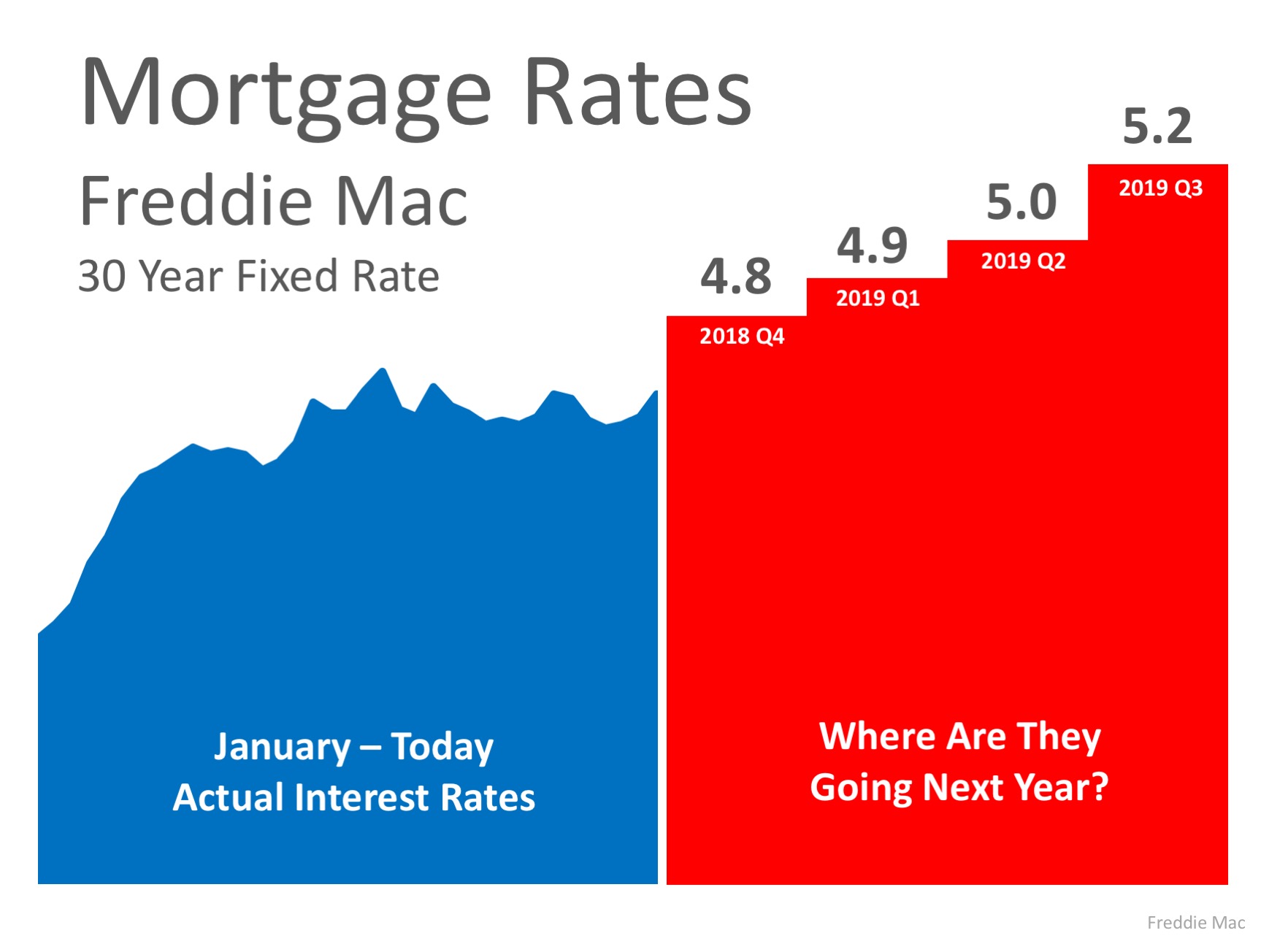

Below is a chart created using Freddie Mac’s U.S. Economic & Housing Marketing Outlook. As you can see, interest rates are projected to increase steadily over the course of the next year.

HOW WILL THIS IMPACT YOUR MORTGAGE PAYMENT?

Depending on the amount of the loan that you secure, a half of a percent (.5%) increase in interest rate can increase your monthly mortgage payment significantly.

According to CoreLogic’s latest Home Price Index, national home prices have appreciated 6.2% from this time last year and are predicted to be 5.1% higher next year.

If both the predictions of home price and interest rate increases become a reality, families would wind up paying considerably more for their next homes.

BOTTOM LINE

Even a small increase in interest rate can impact your family’s wealth, so don’t wait until next year! Let’s get together to evaluate your ability to purchase your dream home now.

We hope you found this content helpful. Contact us today for all your real estate needs.

What’s my HOME WORTH in today’s market?

Oh, by the way … if you know of someone who would appreciate the level of service I provide, please call me with their name and business number. I’ll be happy to take great care of them.

Keller Williams “Highest in Customer Satisfaction” distinction among sellers and buyers – J.D. Power and Associates

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Keeping Current Matters, Inc. does not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.

Comments(0)