Home Buyer Series: How to take the headaches out of buying a Home by a Hudson Florida Realtor::: Part I

Alright people. You do not want to waste your time, and I doubt you want to waste your Realtors times either. So how do you start the Home buying process. When a lot of people think of buying a home they do 1 of 2 things. The latest trend is to go online and start looking around at what is out there. The other, tried and true method, is to contact a Realtor.

Both of these are a mistake, unless you are calling your Trusted Realtor to get a referral to a Mortgage Broker/Banker. That is right folks, if you want to avoid a headache in the home buying process begins with a mortgage specialist. Why you may ask? Because they first thing that needs to be done is to have ones credit report pulled. You can certainly do this for free at home through sites like Free Credit Report.com According to a CBS Report 4 out of 5 reports have mistakes. So than what.

Both of these are a mistake, unless you are calling your Trusted Realtor to get a referral to a Mortgage Broker/Banker. That is right folks, if you want to avoid a headache in the home buying process begins with a mortgage specialist. Why you may ask? Because they first thing that needs to be done is to have ones credit report pulled. You can certainly do this for free at home through sites like Free Credit Report.com According to a CBS Report 4 out of 5 reports have mistakes. So than what.

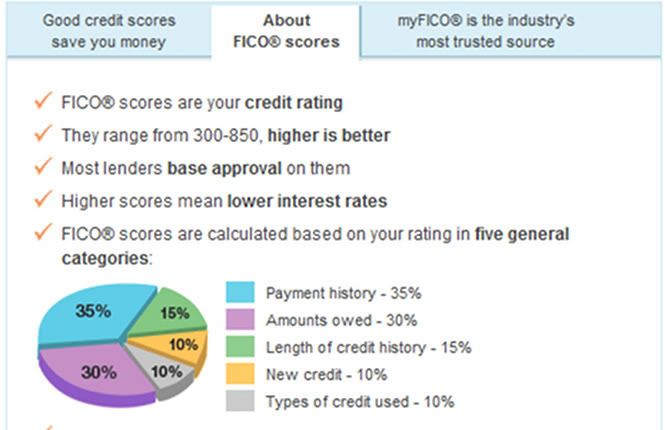

Your mortgage expert is not only going to help you understand your entire credit report, but they will also be able to guide you on how to fix any problems or mistakes eliminating headaches from the Home Buying process. On top of that, a quality mortgage professional will also help you raise your credit rating with simple fixes most people are unaware of, resulting in a lower interest rate when you finally do buy

Now this could take months to accomplish, which is why the home buying process, is...well it is a process that really should be entered into with the assistance of professionals.

So now that you have corrected any errors and dealt with any issues that may have negatively affected your credit rating, you are ready to get your MORTGAGE PRE-APPROVAL or PRE QUALIFICATION. This is basically your mortgage person telling you, under the current financial situation you are in, how much money you are eligible to borrow. Now I, and the mortgage people I work with, recommend you do not max out your budget.

Just because you are eligible for $500,000, that does not mean you have to spend it. You should give your budget a cushion for unforeseen circumstances

your budget a cushion for unforeseen circumstances

This is also a good time to go over the difference between APR and interest rate. Basically, very basically, the APR is the interest rate plus any and all fees/charges/costs associated with the mortgage, annualized and broken down into monthly payments so you can compare various mortgages that may have differing fee structures, to determine which one is best for you. Zillow seems to have a good explanation to get you started

But that is a very remedial definition and you, your mortgage specialist, and even your Realtor should go over this in more detail with actual examples

Comments(0)