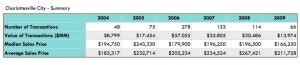

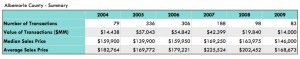

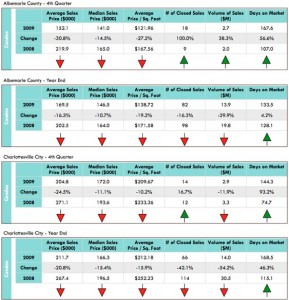

Of all of the real estate options in the Country, condominiums may have been hit the hardest over the last several years. As the Charlottesville real estate market picked up in 2004 and 2005, developers and investors swarmed to purchase apartment buildings to convert them to Condominiums in hopes of cashing in on the real estate boom. The firstCharlottesville condo conversion, Hessian Hills, sold like hotcakes and was completely sold out faster than any of us could blink. However, as others followed, the market began to slow and sales didn’t go nearly as well (see Barracks West condominiums). Obviously, Charlottesville condominium conversions have come to a grinding halt – the cost and risk associated just isn’t worth it for developers. While new condominium inventory isn’t increasing, sales are still decreasing. The lower cost of Charlottesville town homes and single family homes has caused 'would-be' condo buyers to choose townhomes or detached homes instead. And with demand falling off, prices have gone back to 2004 levels. Charlottesville condominium sales peaked in 2006 (The Year of the Condo) at 275 sales in Charlottesville City and 306 in Albemarle County. Since then, the numbers have dropped significantly. 2009 area condominium sales were 83 in Albemarle County and 66 in Charlottesville. Unfortunately for Cville condos, all signs are still pointing in the wrong direction. Sales prices are down. Median prices are down. Price per square foot is down. Total sales volume is down. And Days on Market are up. The lone bright spot on the local condo scene lies in some recent Charlottesville City condo stats: sales in the Fourth Quarter 2009 were up from 12 to 14 as compared to Fourth Quarter 2008. What lies ahead for condos? Some predict that condominiums may be the last segment of the local housing market to recover – they believe that only after single family homes and town homes stabilize will condominium values stabilize and improve. I’m not so sure it’s such a broad answer, though. While I do believe that, as a whole, condos may be behind single family and attached in terms of recovery timeframe, I think that some condominiums that are well located may see quicker recovery. In the end, it’s ‘Location. Location. Location.’ Thankfully, the rental market throughout Central Virginia is extremely strong now. So many condominium owners are able to rent their homes without much of a problem. And while being an ‘accidental landlord’ may not be their first choice, there are plenty of worse places in the Country to own rental property. But here’s a little more positive news for Charlottesville condominiums: some of the newer condos have received or are about to receive FHA Financing approval. Hence, financing will be easier to obtain…and, thus, easier to sell. Expect the FHA Approved condos to be part of the recovery.

Gibson Management Group, Ltd. - Charlottesville, VA

LandlordWhisperer

Older, apt-condo conversion units will be the last to recover as they are older and have higher common area maintenance costs.

Newer LARGER units like Carriage Hill, Glenwood Station and Walker Square will recover faster as they are excellent units for downsizing and commuting to work

Jan 29, 2010 12:10 AM

Jonathan Kauffmann, Principal Broker of Nest Realty - Crozet, VA

As a whole, I would probably agree with that statement. I think the biggest variable in the 'recovery' equation is still location. I'd say that an older condo in the City that is walkable to the Mall would be the first to recover, then a newer condo in a great location (like Walker Square, for example).

Thanks for your comment.

Jan 29, 2010 12:39 AM

Comments(2)