Home Sales Data, June 1-15, 2010 Sumter and surrounding areas, SC

This information includes residences only; I did not include land or commercial properties. I looked only at Sumter and the surrounding area.

For the period June 1-15, 2010, there were 109 new listings placed on the market. Lowest list price was $8,500 for a 60-year-old bank-owned duplex. Highest list price was $699,000 for a 12-year-old bi-level custom-built waterfront home in a gated community. Twelve of the new listings are new construction, one is a condo/townhouse and two are duplexes. Two of the new listings were withdrawn - one after being on the market for 13 days, it may have been rented rather than sold, the MLS isn't clear on that; and one was withdrawn after being on the market for 17 days but I can't figure out why. One new listing went pending after being on the market for 4 days. Ten of the new listings are REO (bank-owned) and one is listed as a short sale.

Fifty-six (56) properties sold (closed) from June 1-15, 2010. Lowest list price was $19,900 for a 10-year-old bank-owned mobile home that sold for $18,950 cash after being on the market for 92 days. Highest list price was $319,900 for a newly constructed brick home full of custom features that sold for $314,900 after being on the market for 162 days. Eight of the sales were new construction, none were condo / townhouses or duplexes. Nine of them were listed as REO (bank-owned) and none were listed as short sales.

Of the 56 properties sold, 16 were listed for at or below $100,000. Average days on market was 183 and median days on market was 145.5 (ranged from 43 to 634). Average list-to-sales price percentage was 88.86 % and median list-to-sales was 94.91% (ranged from 53.4% to 102.41%).

Twenty-eight (28) of the sold properties were listed above $100,000 and below $200,000. Average days on market was 148, and median days on the market was 122 (ranged from 34 to 400). Average list-to-sales price percentage was 97.17% and median list-to-sales was 98.92% (ranged from 75.52% to 104.4%).

Ten (10) of the 56 sold properties were listed above $200,000 and below $300,000. Average days on market was 173 and median days on market was 161 (ranged from 71 to 268). Average list-to-sales price percentage was 98.93% and median list-to-sales was 98.43% (ranged from 95.56% to 106.71%).

The remaining listing which sold was listed above $300,000 and below $400,000; it was the highest-priced listing mentioned above. It was listed for $319,900 and sold for $314,900 (98.44% of the list price) after being on the market for 162 days.

In contrast, for the same period a year ago (June 1-15, 2009), 119 properties were newly listed. Lowest list price was $21,300 for a then 32-year-old privately owned house that sold for $20,300 cash after being on the market for 53 days. Highest list price was $499,000 for a then 19-year-old waterfront home with a dock, boathouse and tons of amenities including a home generator -- and it's still on the market. Twenty-five of these listings have expired, 23 were withdrawn, one was rented rather than sold, one was deleted, two are pending, and 13 remain active. Seventeen (17) of them were new construction, none were duplexes or condos/townhouses. Nine were listed as REO (bank-owned) properties and one was listed as a short sale.

Between June 1-15, 2009 48 properties sold (closed). Lowest list price was $19,900 for a then 55-year-old bank-owned bungalow that originally listed for $$29,900 and underwent two price reductions before selling for $17,000 cash after being on the market for 123 days. Highest list price was $385,900 for a then 3-year-old 1 1/2 story home in a golf-course community that sold for $373,950 after being on the market for 114 days. Six were new construction and one was listed as a duplex. Five were listed as REO (bank-owned), and two were listed as short sales.

Of the 48 properties sold, 18 were listed at or below $100,000. Average days on market was 183, median days on the market was 140 (ranged from 1 to 795). Average list-to-sales price percentage was 91.18% and median list-to-sales was 95.02% (ranged from 70.09% to 105.88%).

Twenty-four (24) of the 48 sold properties were listed above $100,000 and below $200,000. Average days on the market was 146 and median days on the market was 107.5 (ranged from 36 to 477). Average list-to-sales price percentage was 98.41% and median list-to-sales was 98.85% (ranged from 84.65% to 105.27%).

Two of the sold properties were listed above $200,000 and below $300,000. Average and median days on the market was 94 (ranged from 40 to 148). Average and median list-to-sales price percentage was 92.79% (ranged from 88.35% to 97.23%).

The remaining four listings were listed above $300,000 and below $400,000. Average days on the market was 345, median days on the market was 369 (ranged from 114 to 527). Average list-to-sales price percentage was 98.62%, median list-to-sales price percentage was 98.45% (ranged from 94.31% to 103.25%).

At the moment there are 1,480 residential properties on the market in the Sumter MLS. One hundred seventeen (117) homes sold (closed) in the past thirty days. Unless something changes, we have a little over 12.65 months of residential inventory on the market. Yikes.

Some market reports indicate the market is picking up a bit in our area. We all hope that turns out to be true. I'm not sure there's enough data yet to support an opinion one way or the other.

And now, fun with graphs and charts. Last time I bit off more than I could comfortably chew, so this time I'm keeping it simple.

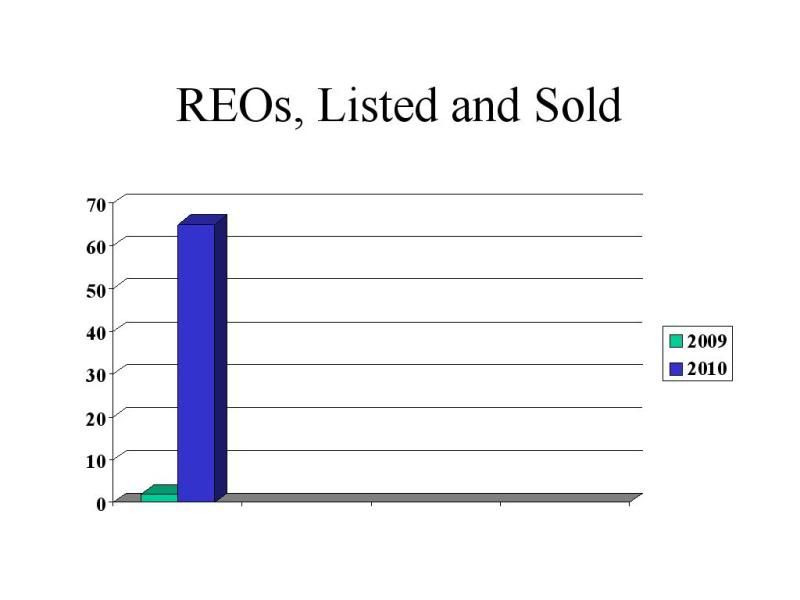

The problem with crunching numbers based on what's in the MLS is that I'm wholly dependent on what the listing agents put in. Some agents have been known to, shall we say, not pay very close attention to what they're typing in. Sometimes banks have stated they do not want the properties they have listed specified as "REO" in the MLS. I know all this, and yet when I thought I'd try looking at what we had listed and sold in the way of REOs from January 1st through June 30th for this year and last year, I somehow thought I'd get something, you know, useful.

Well, not so much.

In January 1st through June 30th of last year, there were two REO's listed and sold. In January 1st through June 30th of this year, we had 65. It's possible that there really was that drastic increase in bank-owned properties being listed and sold. It's also possible that there were a lot more in 2009 than is readily apparent. I tried going through the CRS (Courthouse Retrieval System) but it wasn't helpful either. I even went back into 2008 to try to find something, anything to compare to. There were none in 2008 at all. At least, not in our MLS.

Anyway, the chart is moderately interesting, I guess. (Based on information from the Sumter Board of Realtors(®)/MLS, June 19-20, 2010)

(Based on information from the Sumter Board of Realtors(®)/MLS, June 19-20, 2010)

Comments(0)