Today's Austin American-Statesman included an article about the state of our local real estate market:

Home sales slow, listings surge

The focus of the headline is on single family homes, and the growth of listing inventory this year:

I commented on the same trend on AustinMarketDashboard.com. The difference in my site and the data used by the American-Statesman is my inclusion of all residential properties rather than only single family homes.

There is no doubt that sellers' expectations for the summer selling season coupled with two rounds of homebuyer tax incentives which accelerated demand has left the Austin/Central Texas market with inflated listing inventory. It is also true that June sales were down 3.7% from May and 1.8% compared to April. On the other hand, June home sales were 10.8% higher than in March. This is clearly the effect of the homebuyer tax credit program that required closing by June 30.

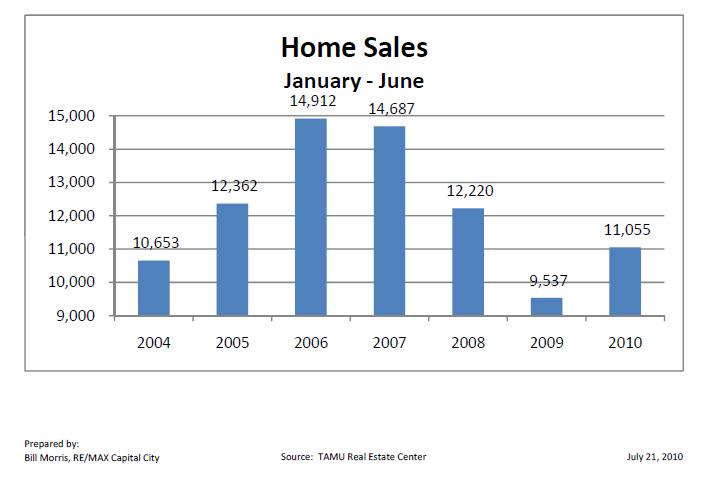

I was never an advocate for these incentives because I do not want the real estate business to become dependent on "specials" the way the car business has, but these programs have boosted sales this year. Here is a look at year-to-date home sales in the Austin metropolitan year at the end of June in each of the past seven years:

We should expect that July, and possibly August, sales will be low because the tax incentives caused buyers to move sooner than they would have otherwise. How much seasonal demand has been distorted remains to be seen. In addition, general softness in the economy -- employment outlook, consumer confidence, trends in capital investment, etc. -- will affect home sales in the coming months. It is encouraging, though, to see YTD sales 16% higher than the same time last year. (And keep in mind that the first tax credit program pulled home sales into the 4th quarter of last year in the same way that the extended program moved sales into May-June 2010.)

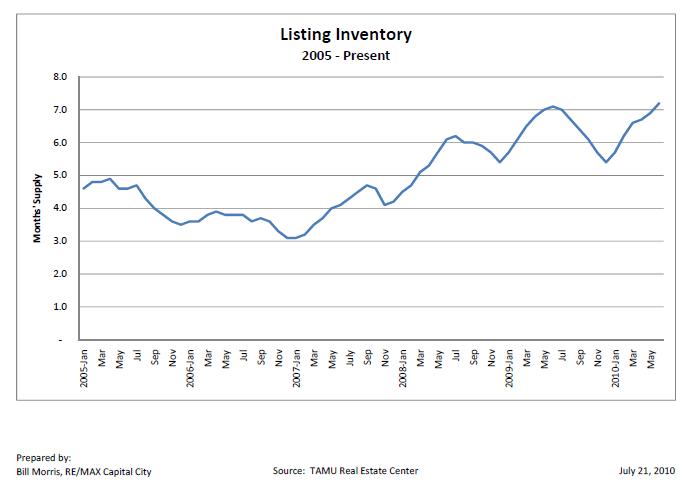

Discussing listing inventory is most valid in the context of demand. This chart shows how long existing listings would last at the current pace of sales:

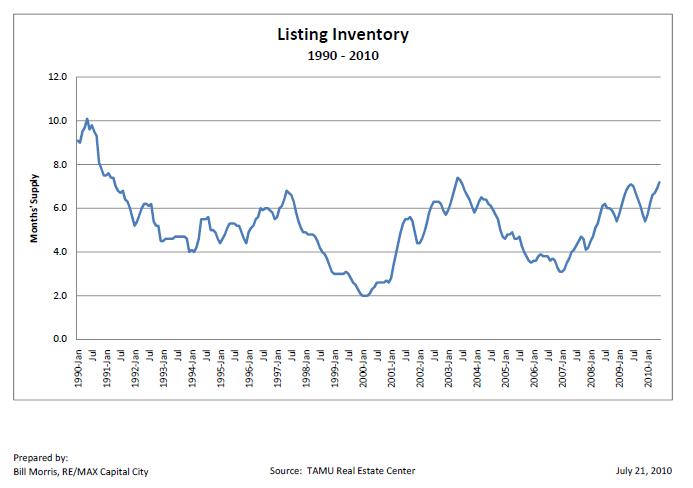

Most analysts consider 6 to 6 1/2 months' inventory to be a "balanced" market -- favoring neither sellers nor buyers. In that context, 7.2 months' supply is not all that alarming. Again, however, we have no way of knowing how long homebuyer demand may be reduced because purchases were accelerated by the tax credit programs. For a longer term perspective, consider this chart showing listing inventory over the past 20 years:

We have been here before. June 2010 inventory is very much like June-July 2003, just before the housing boom that peaked in 2006-2007. Today's inventory is only slightly higher than in May-June 1997, at the beginning of the dot-com boom, the market cycle that peaked in 2000 when that tech boom went bust. For further comparison, look at the inventory level in mid-1990 -- 10 months' supply in May 1990, with enough inventory to last more than 9 months for virtually all of that year. That was the result of the savings and loan crisis, a flood of home foreclosures, the formation of the Resolution Trust Corp, and a crisis in home values much like what we have seen in this cycle.

Every market cycle is different, and today's downturn and recovery depend much more on international economies and investor confidence than the 1989-1990 period. Even in Austin -- as strong as our market has remained -- we are not through this storm yet, but we have been in similar circumstances before, and we probably will be again. In the meantime, I remain confident that we will see a meaningful recovery and good market appreciation in coming months and years.

Comments(0)