2 Myths Holding Back Home Buyers

In a recent article, First American shared how millennials are not really any different from previous generations when it comes to the goal of homeownership.

Saving for a down payment is one of the biggest obstacles faced by first-time home buyers.

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate how much they need to qualify for a home loan.

While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a little research, many renters may actually be able to enter the housing market sooner than they ever imagined.

Myth #2: “I Need a 780 FICO® Score or Higher”

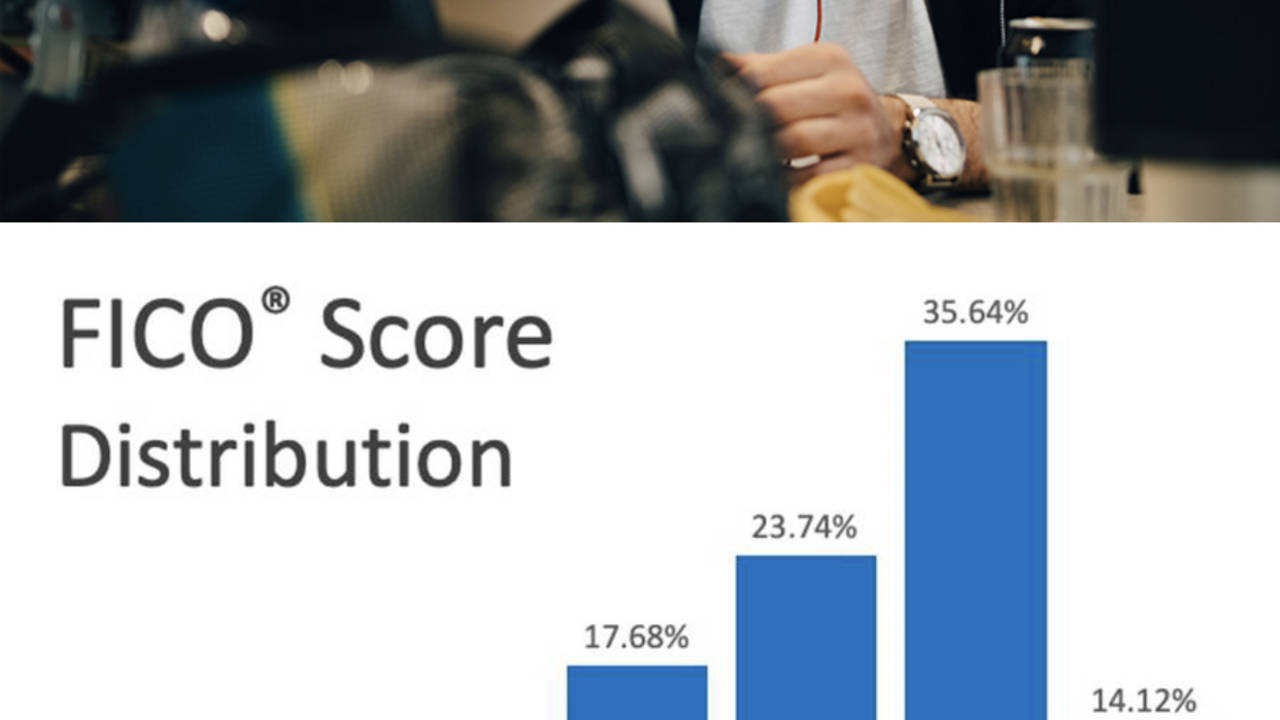

In addition to down payments, buyers are also often confused about the FICO® score it takes to qualify for a mortgage, believing a ‘good’ credit score is 780 or higher.

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. 50.23% of approved mortgages had a credit score of 500-749.

Believe it or not – your dream home may already be within your reach. Connect with me to discuss. #realestate #localexpert #you #holidaymarketingprogram #letstalk

2 Myths Holding Back Home Buyers

Comments(0)