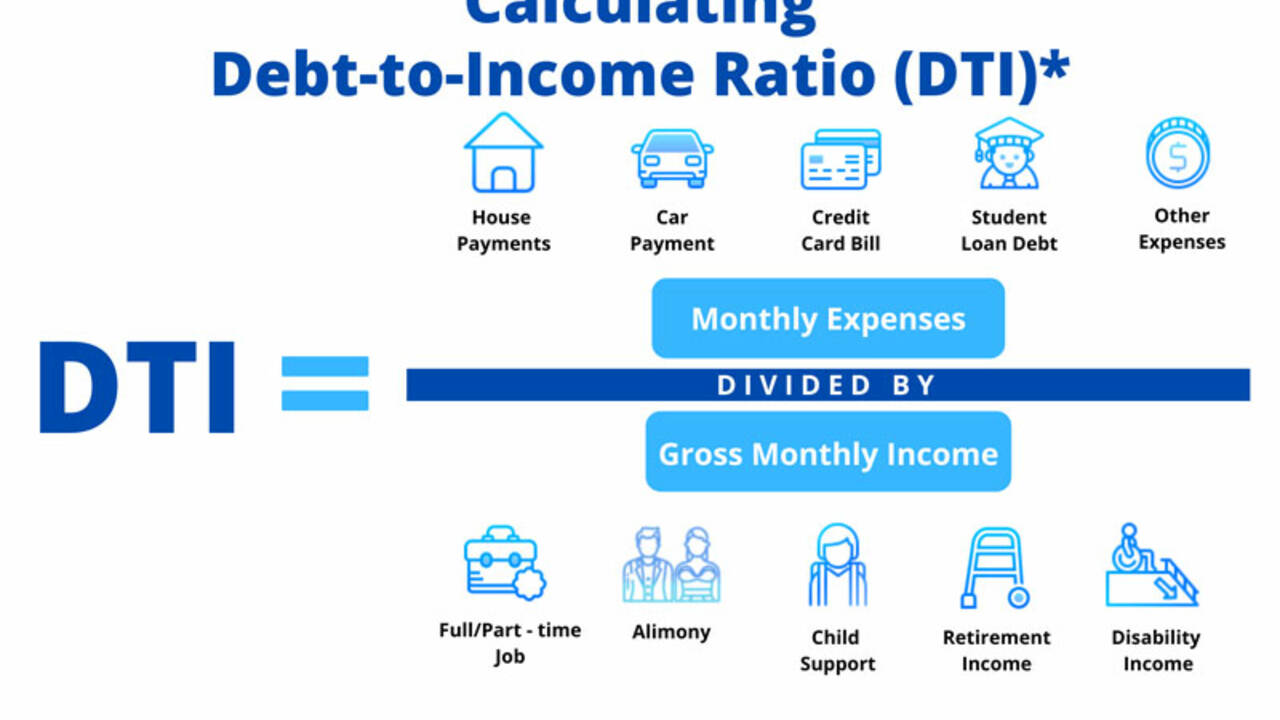

The debt-to-income ratio, often referred to as the debt-to-income ratio (DTI) or debt-to-income ratio (DTIR), is a measure of your borrowing risk that lenders take into consideration when considering your loan application.

Understanding the Debt-to-Income Ratio (DTI)

A good debt-to-income balance (DTI) ratio indicates that you have a reasonable amount of debt versus earnings. In other words, if your DTI ratio is 15%, that means that 15% of your monthly gross income goes toward debt payments each month. A high DTI ratio, on the other hand, might indicate that a person has too much debt for his or her monthly income.

Borrowers with low debt-to-income ratios are typically able to handle their monthly debt obligations effectively. As a result, banks and financial credit providers want to see low debt-to-income ratios before offering loans to a possible borrower. Because lenders want to ensure that a borrower isn't overly indebted, they prefer low DTI ratios.

- The debt-to-income ratio (DTI) is a mathematical calculation that compares a person's or company's income to the amount of debt they must pay.

- The highest ratio a borrower can have and still be qualified for a mortgage is 43%, although most lenders want ratios of no more than 36%.

- A high DTI indicates a borrower who has more money than debt payments, making him or her seem less risky.

The Debt-to-Income Ratio (DTI) is a measure of how much debt a loan applicant has compared to his or her income. As a rule of thumb, the highest possible DTI ratio for an applicant to be qualified for a mortgage is 43%. Lenders typically desire that debt-to-income ratios are lower than 36%.

The maximum DTI ratio varies based on the lender. The lower a debt-to-income ratio is, the more likely it is that the applicant will be accepted for the credit application, at least in theory.

How to Calculate DTI - Example

Jacob is trying to figure out his debt-to-income ratio after learning that he needs a loan. The following are Jacob's monthly expenses and income:

- car loan: $250

- mortgage: $800

- gross income: $8,500

- credit card payment: $400

Jacob's monthly debt payment: $400 + $250 + $800 = $1,450

Jacob's DTI is 17% ($1,450 / $8,500)

Can I Avoid Calculating a DTI and Get a Loan?

Some borrower which have very high DTi can get a loan without calculating the DTI. Most common loans require DTi Calculation like FHA, VA, and USDA. However, for DSR/DSCR loans or NO-DOC loans, the DTI is not required. In most cases, you need to put down a minimum of 20% to qualify for this type of loan. Please feel free to reach me with the email below if you're looking to finance your property or do a cash-out refi. We do business in 48 states, we don't have overlays on government loans and we are brokers (with the biggest amount of investors - 170) so you will get the best possible rate for any product available on this crazy market.

If you enjoyed this post, then

subscribe to my blog so that you do not miss out on what I may say next!

Free Realtor Guest Post Advertising on multiple websites

please email me at chicago@kw.com

Have a great day, ~Peter

Comments(6)