In early May, several of my preferred agents had deals fall out of their pipelines because their clients were not locked - and rates rocketed. The sudden spike in rates took many borrower's by surprise and tore right through lender debt ratio cielings.

As I wrote yesterday, as we inch closer to this debt ceiling deadline, rates are going to rise. As you can see by the chart below, rates flattened since the goverment shutdown. As Washington toes towards the October 17th deadline to raise the debt ceiling, bond traders will get nervouse and in return sell off and bond yields will rise - and that means rates will rise. And as you can see from the past trends on the 10 Year Treasury, rates spike fast.

Reccomendation - Encourage your clients to lock in their rate and not flirt with disaster like our elected representatives presently are.

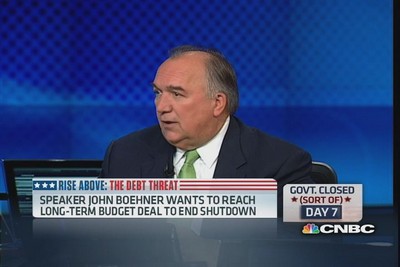

Yes, it is true that we will most likely get a 23rd hour passage of the debt ceiling, but as we have saw in 2011 when the same set of circumstances presented themselves, investors will spook and the markets will react. Below the chart is a copy of a CNBC article about the debt ceiling

10 YEAR U.S. TREASURY YIELD - Mortgage backed securities and mortgage interest rates and their movements mirror that of the 10 Year U.S. Treasury

Chart Courtesy of CBS Marketwatch

What a spike in T-bill yields says about default risk

Comments(2)