How Smart Is It to Buy a Home Today?

NOW is the right time.

Best wishes for a successful week! Onward!

How Smart Is It to Buy a Home Today?

Whether you’re buying your first home or selling your current house, if your needs are changing and you think you need to move, the decision can be complicated. You may have to take personal or professional considerations into account, and only you can judge what impact those factors should have on your desire to move.However, there’s one category that provides a simple answer. When deciding to buy now or wait until next year, the financial aspect of the purchase is easy to evaluate. You just need to ask yourself two questions:

- Do I think home values will be higher a year from now?

- Do I think mortgage rates will be higher a year from now?

From a purely financial standpoint, if the answer is ‘yes’ to either question, you should strongly consider buying now. If the answer to both questions is ‘yes,’ you should definitely buy now.

Nobody can guarantee what home values or mortgage rates will be by the end of this year. The experts, however, seem certain the answer to both questions above is a resounding ‘yes.’ Mortgage rates are expected to rise and home values are expected to appreciate rather nicely.

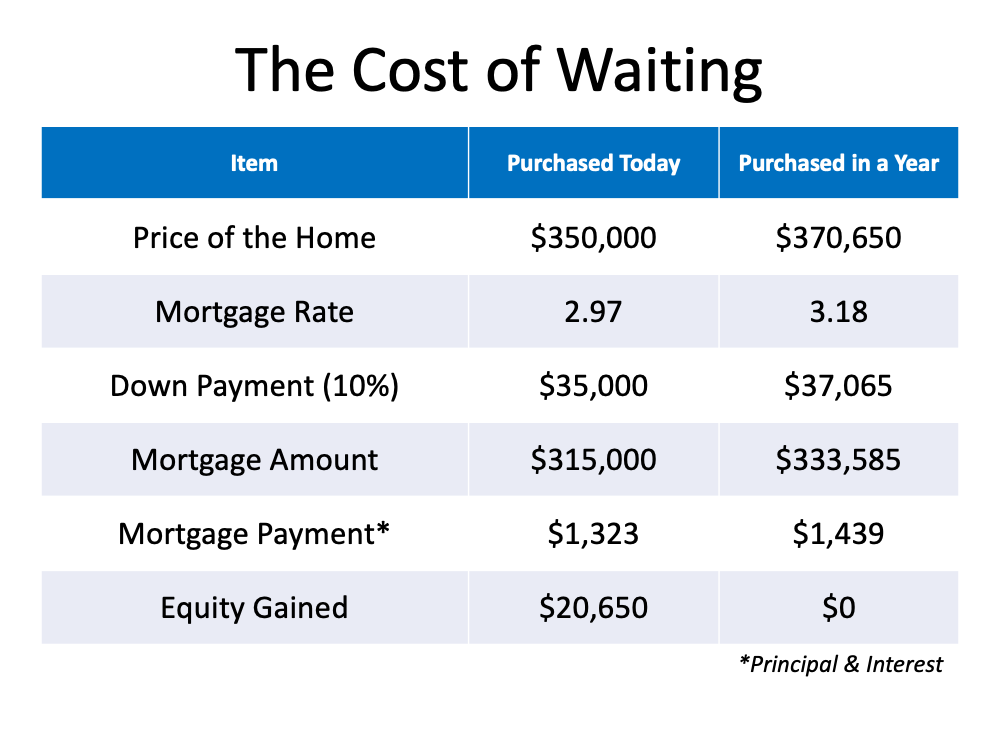

What does this mean to you?Let’s look at how waiting would impact your financial situation. Here are the assumptions made for this example:

- The experts are right - mortgage rates will be 3.18% at the end of the year

- The experts are right - home values will appreciate by 5.9%

- You want to buy a home valued at $350,000 today

- You decide on a 10% down payment

Here’s the financial impact of waiting:

- You pay an extra $20,650 for the house

- You need an additional $2,065 for a down payment

- You pay an extra $116/month in your mortgage payment ($1,392 additional per year)

- You don’t gain the $20,650 increase in wealth through equity build-up

Bottom Line

There are many things to consider when buying a home. However, from a purely financial aspect, if you find a home that meets your needs, buying now makes much more sense than buying next year.

Let’s connect to discuss what best fits your financial goals. Contact Kris Collis, your Trusted Pro in the Poconos, for professional results in all market fluctuations. With years of area knowledge and repeat clients from trusted service and personalized guidance each step of the way, let’s take a look at Pocono opportunities that benefit you. The home you're looking for is here, whether for your family, workplace, retirement or vacation/secondary home needs.

"A Trusted Relationship with Professional Results You Expect"

Kris Collis, Associate Broker

East Stroudsburg, PA 18301

570-801-5525

Mail to: buysellpocono@gmail.com

Comments(3)