They're here! Every year around this time the Federal Finance Housing Authority (FHFA) announces loan limits for the next calendar year. These limits are adjusted based off of year over year home appreciation metrics usually noted by 3rd quarter results from appreciation reports.

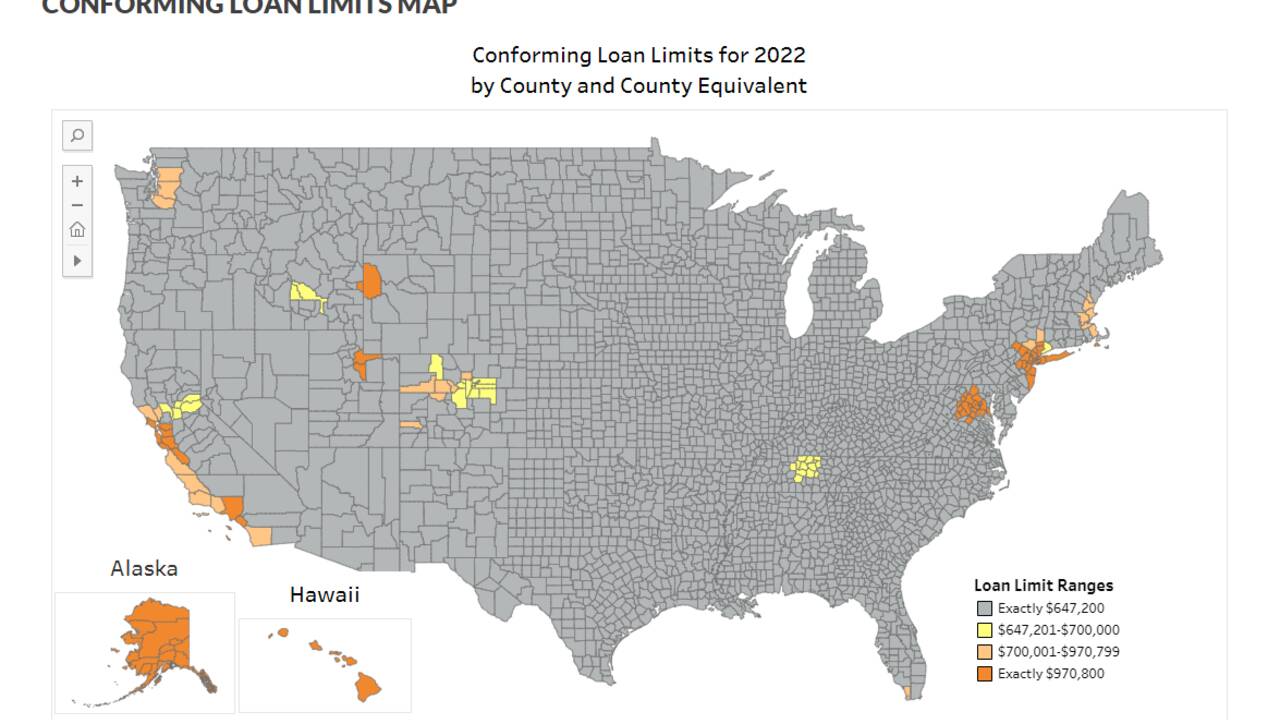

For 2022, loan limits have followed home prices in increasing by a large margin! The base conforming loan limit has increased by nearly $100,000 to $647,200 nationwide. In high cost areas, loan limits have increased to a staggering $970,800. Yes, this means that nearly $1 million can be borrowed under conventional loan guidelines (aka, 5% down payment!). Loan limits are even higher for multi-unit homes, and will vary from county to county based on local home value median figures.

Loans can begin to be processed under these new loan limits immediately, although loans in the new limit ranges may need an extra few days logistically as lenders reprogram their pricing and locking engines, and lenders establish guidance to process loans with automated underwriting "declines" (the systems at Fannie Mae & Freddie Mac often lag in issuing approvals for the new loan limits by a couple weeks).

While this is largely good news, especially for those struggling to compete with limited down payment funds in higher priced markets, such a large increase (and the fact that government sponsored agencies are now on the hook for what just a couple of years ago would have been loan amounts well into jumbo loan territory - where perfect credit and a 15-20% down payment is generally required) does raise eyebrows and come with some negative impacts. With more financing flexibility, home prices are given room to climb even higher (5% down allows for conventional financing on a home purchase of $680K+), which could increase buyer competition in homes around these price ranges.

HUD typically follows shortly behind FHFA so we should anticipate updated FHA loan limits to be announced in the coming weeks, and an increase to FHA limits would be even more helpful to entry level buyers competing in markets where home prices have outpaced FHA loan allowances.

Want to know what loan limits are for your county? How does this impact your buyers? Feel free to ask an expert here, or check out the attached graphic which shows loan amount maximums by county, indicated by the various colors shading each county in the US.

Comments(4)