Don’t be CASH POOR – CASH is KING

FHA loans have been used more in recent years. Many have talked negatively about FHA loans because of their high default rates as of lately. Don't be fooled by chatter that is not backed up by fact and why this is happening. Please read : Should we ABOLISH FHA loans?

FHA loans have been used more in recent years. Many have talked negatively about FHA loans because of their high default rates as of lately. Don't be fooled by chatter that is not backed up by fact and why this is happening. Please read : Should we ABOLISH FHA loans?

One of the main myths that I wanted to dispell in this blog post is that you don't need 20% to buy a home in today's real estate market or that you need a 720 credit score. These are bad myths and rumors. You can read about it here : Credit scores/FICO scores - I need a 700 credit score?

Yesterday, I wrote a post about comparing a FHA mortgage to a Conventional mortgage with 20% down. FHA loans vs Conventional loans - A real comparison with 20% down. - Overall, it all comes down to the borrowers needs and goals. Yet not all loan officers dig this deeply. Usually because the focus is lost when the borrower wants to know the mortgage interest rate and fees. More on that in a post on Sunday.

Please read these links before moving forward (the next 3) : It’s extremely important

Please read this question about why my conventional rates are so much higher : Someone's question to why my conventional rates are so high.

My response : Just a basic response to why the conventional rates are much higher.

And proof that it's not just me.. all lenders need and have to follow the same pricing hits. Conventional PRICING HITS

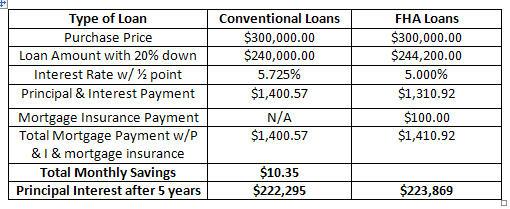

What is the big fuss of putting 20% down other than you don't have mortgage insurance? Here is my chart from yesterday.

Loan comparison of 20% down between FHA loans and Conventional loans

SCENARIO # 1

In regards to scenario #1, this is great if you have 20% down. But is it? Please read why going with a conventional loan with 20% down still might not be your best option. 20% down comparison between FHA loans and Conventional Loans Hint: Goals -

Dropping the down payment by 1%, making it 19% down and not 20% down.

Scenario # 2

Scenario # 2 - There is no large difference except that your monthly mortgage payment is lower on a FHA loan when putting less than 20% down. **Conventional mortgage insurance is not standard as it use to be. Meaning that these figures could change depending on the insurance company, the fico score, and in some cases, where you purchase the property.**

Loan comparison of 10% down between FHA loans and Conventional loans

Scenario # 3

As you can see, when you put less than 20% down, and depending on your credit scores, FHA mortgages will be much cheaper in the monthly mortgage payment. I give a better description and understanding of the differences in this blog post : 10% down comparison and understanding the upfront mortgage insurance on FHA loans vs conventional loans.

My whole point to this post though is about cash, cash savings, and reserves. And in today's economy, cash is king. Let's look at it this way.

Loan comparison – Conventional loan w/20% down vs FHA loan w/10% down

Overall, there is no true correct answer. It first must come down to how comfortable you are in your finances. But here is a clear indication that just because you put down 10% more, which is an additional $30,000, doesn't mean your payment drops as signficantly as many of you might think. (this will vary depending on loan amounts) Don't get me wrong, saving an additional $186.71 a month can be huge. But at the same time, you could keep $30,000 in your pocket instead. If you want to try and compare apples to apples, just take the difference out of the monies that you saved from your 10% down payment. Set aside $11,200 in a seperate account to lower your payment. It would still leave you with $18,794 now, after closing.

One word of advice.... you don't have to try and pay down your mortgage as soon as possible. Yes, this is a good security blanket for so many. But you also don't know what the future holds for you. Besides, you could take $10,000 of your money left over and invest it in several areas that would give you a better return of 7% to 8%, especially since you are paying 5% on your mortgage. But you would need to speak to a financial consultant about this.

Summary : No matter how much cash you have or don't have, this is how your loan officer should help you understand your mortgage and financial situation. Cash can be king and be useful in unknown emergencies. Don't always fall for those commercials that scream, "don't let the banks rip you off, learn how to pay off your mortgage quickly".(you don't need these programs, such as the mortgage accelerator programs... you can do this on your own)

On another note, I am not saying that your loan officer needs to show you this exact breakdown. But it's more than just about the best interest rate and or fees. What is the best program for you based on your goals and the mortgage program. I will be talking about this over the weekend. Stay tuned.

Knowledge is Power... And don't forget that you can still put down 3.5% with FHA loans, as opposed to conventional loans needing 5% to 10% down.

Disclaimer : The rates are examples in today's market, aren't any form of advertising, and aren't for solicitation of new business. It's merely to educate the consumer. And the spread shown in these examples are real as in the profit margins for both sides, in order to compare apples to apples. The conventional rate also includes the penalty for the 659 credit score and down payments. This is because of the large pricing penalty for the credit score.

For more FHA loans vs conventional loans comparisons :

- FHA loans vs Conventional loans - A true numbers comparison with 5% down - 12-20-08 -Using a 710 credit score

- FHA loans vs Conventional loans - A real comparison with 5% down - 11-15-08 - Using a 659 credit score

- FHA Loans vs Conventional Loans - 20% down - A Rude Reality Check - 04-03-09 - Would you believe that FHA loans could be cheaper even with 20% down? Come see why and how.

- FHA Loans vs Conventional Loans - 5% - 4 comparisons that you need to know - 05-02-09 -Comparing a FHA loan against 3 types of conventional loans with different types of monthly mortgage insurance. Guess who won while still using a 679 credit score.....

- FHA loans vs Conventional loans - Knowing the true comparisons - 07-10-09 - A great comparison with a 679 credit score and 5% down. This example will still show that even with a better than average credit score, that FHA loans are still better in many cases.

- FHA loans vs Conventional loans - Things you need to know with 10% down, especially in regards to Condos - 09-19-09 -

Donw Payment Series - A Must Read -

- FHA loans vs Conventional loans - A real comparison with 20% down - Part 1 of 3 - 01-28-10 - Not much of a difference, unless you stay in the house for more than 5 years. Hence why a loan officer should be talking about your goals. So very important, yet many dont ask.

- FHA loans vs Conventional loans - Don't be cash poor!! - Part 2 of 3 - 01-29-10 I want to show even a bigger difference if you put less down. And even if you decided to put less than 10% down, because cash is king now. You can't predict even next week. And keeping in mind of some misleading rumors, that you need more than 10% down to buy a house.

- FHA loans vs Conventional loans - Get a bang for your buck - Large down payments aren't always the best way - Part 3 of 3 - 02-03-10 - Some great examples of having cash left over and not really affecting your monthly mortgage payment. And that you will have cash left over for emergencies. Keeping in mind that cash is king.

- Make sure you know about the NEW FHA loan changes : FHA loan changes for 2010 & why they changed. Reasons for these FHA changes and when they go into effect.

FOLLOW ME ON FACEBOOK

- FHA Loans - USDA Loans - VA Loans -

- Energy Efficient Mortgages -

- Conventional Loans - 203 k loans -

- Mortgages -

Experience & Knowledge at its BEST !!!

_________________________________________________________________________________________

For more information on FHA loans, please go to this link. The FHA Expert

For more information about the 2009 Tax Credit for First Time Homebuyers : 2009 Tax Credit

For important mortgage insight to watch for, please read : Consumers need to be aware of these Red Flags!

Copyright © 2010 by Jeff Belonger of Infinity Home Mortgage Company, Inc

Comments(38)