I am a big advocate for Real Estate Investors getting the best return possible on your money. Well we have all been taught (or are learning right now) to avoid credit and pay cash when ever possible.

However, this does not hold true for Real Estate Investing. When it comes to Real Estate Investing you want to maximize your return on investment. This means borrowing as much of the purchase price as possible for your Real Estate Investment.

The initial reaction of many Real Estate Investors is negative. The two main objection I hear is the interest rate is higher when you put less down or the payments are such that there is no profit in the Real Estate Investment.

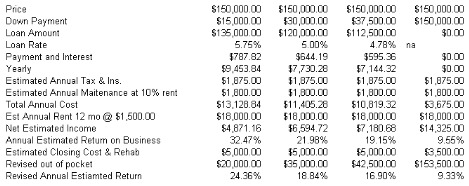

My point comes back to the fact the key issue, in most cases, is the amount of profit you are making on the actual cash out of pocket is the determining factor in how profitable a Real Estate Investment is. I have prepared a chart on a potential Real Estate Investment in Antioch California. Take a look at the numbers prepared based on 10%, 20%, 25% down, and cash.

The numbers are not even close. This is an example and all Real Estate Investments will vary. But the numbers are based on real life properties and opportunities.

I work with Real Estate Investors all over the place. My office is in East Contra Costa County near the Cities of Antioch, Brentwood, Oakley, Discovery Bay, and Pittsburg.

Call me or e-mail me for more information. Find out about how to get a Real Estate Investment with only 10% down! For Valuable Information get my Free Book on Real Estate Investing!

Check out My Post On Getting Started Right on Real Estate Investing!

Comments(17)