OK I'll admit it... I've been reading the Bubble Bloggers. I periodically check out what they have to say to find out what people supposedly outside the industry are thinking. I note that because for civilians many of them have a lot of information that can only come from a local MLS.

I'm noting some major changes in the last 6-8 months on most of these blogs. For one thing the authors have either gotten day jobs or don't have as much to say because the number and frequency of posts has declined on most sites. The volume of readership has also decreased compared last year when the media frenzy was at it's height predicting 30%-50% price declines. While we are still no good rotten greedy REALTORS® much of the really nasty rhetoric seems to have quieted down a bit. I did notice that a few are now making up their own charts as the data from Data Quick isn't meeting their theories or predictions. They are still carping about the same small number of non-selling properties to show how bad the market is... when the reality is those properties were way over priced in the beginning and in most cases still are considering their locations and condition. Putting a price on a property doesn't make that the market price... it just makes it a listing price... big difference. There are still a few sellers and their agents who are waiting for 2005 to return. They are of course the polar opposites of the buyers who are waiting for the market of 1997 to return.... both I believe will be sorely disappointed.

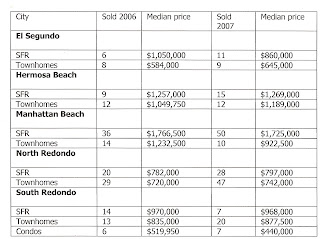

One of the nice things about blogging for a long time is that you can pull information from older posts. I thought it would be interesting to check the differences and similarities in prices in March 2006 compared to March 2007 in our local beach cities market. With all the ongoing discussion about the imminent crash of the California real estate market I found these numbers more reflective of a normal market then one poised to fall into the abyss.

March 2006 Sales vs March 2007 Sales: South Bay/Beach Cities

Manhattan Beach, Hermosa Beach, Redondo Beach and El Segundo

As you can see.. overall sales volume is slightly higher and prices are fairly even with minor discrepancies that are to be expected when slightly more expensive properties sell in one month compared to another.

Oh yeah.. there's one other little statistic.. South Bay Beach Cities continue to be some of the most expensive in the state. Manhattan Beachmakes the list almost every month. Now truthfully I don't know if that's good... because it means our economic base for buyers in our area is stronger... or bad as we are just so pricey there is only a small group who can afford to purchase a home in the Beach Cities. Inventory has declined because property is selling not expiring as the bloggers would like to believe. It's not selling quickly and over priced properties will continue to sit but it is an improvement over last year as the number of sales indicates.

It appears we may have reached that place called a normal market. Most people don't remember what that is but the general characteristics are...prices move up and down as does the volume of sales. The key to a normal market is no highs or lows... just mellow for a period of time. I know.. what about the massive number of foreclosures that are looming on the horizon? Well as DQNews notes in an article about rates of foreclosure in California.. it seems that in LA County while there have been large increases in Notices of Default the number of foreclosures is 60% below the peak period of 1996. The article also points out that the big problems are not likely to be in LA, Marin or San Francisco Counties. Check the cities on the ten most expensive list below and you will see that most of them are in counties that may be least affected by foreclosures.

The 10 cities and communities with the highest median home prices in California during March 2007 were:

Los Altos: $1.66 million

Manhattan Beach: $1.61 million

Saratoga: $1.57 million

Newport Beach: $1.4 million

Burlingame: $1.31 million

Santa Barbara: $1.1 million

Los Gatos: $1.08 million

Lafayette, $1.05 million

Rancho Palos Verdes: $1.04 million

Danville: $1.03 million.

Manhattan Beach: Market Snapshot March 17, 2007

Manhattan Beach: Market Snapshot March 5, 2007

Beach Cities Sold March 2007

Beach Cities SOLD February

Beach Cities SOLD January

Manhattan Beach and all Beach Cities Real Estate Information

All content copyright © 2007 Kaye Thomas

Comments(30)