I represent taxpayers in Boulder, CO and Denver, CO Metropolitan, CO who have issues with unpaid taxes and outstanding tax liabilities, back taxes and wage garnishments.

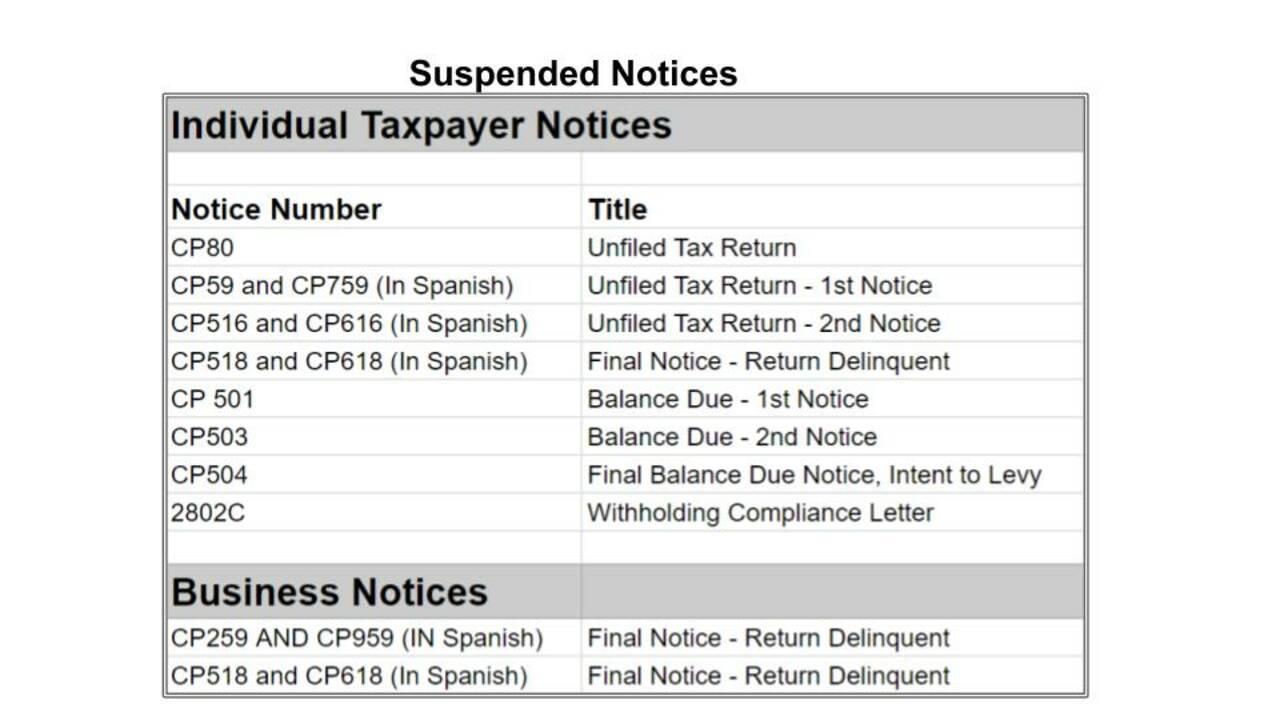

The IRS started accepting 2021 tax returns on Jan 24, 2022 while they still have several millions unprocessed original and amended tax returns returns filed of individual, business. The IRS commissioner Chuck Retting announced on February 9, 2022 that in an effort to start successful this filing season and process the previously unprocessed inventory, they have suspended sending these aromatic notices. The IRS will assess their inventory of prior year tax returns to determine the time to resume the notices.

What it means for taxpayer?

If the taxpayer know the that they owe money to the IRS and notices are accurate, they should try to resolve the issue because interest and penalties will continue to accrue. The taxpayer who has refund due need to have patience.

If you or someone you know have additional questions regarding tax relief, unfiled tax returns, tax payments, liens and levy, or other tax related matters, please give me a call or send me a message.

Related resources

Can the IRS Send You a Notice if You have Refund Due

The IRS Letters & Notices Update

Taxpayers with the notices that require a response should contact the office immediately for assistance. Many tax preparers and accounting professionals are extremely busy due to the complexity of tax regulations brought about by the COVID-19 pandemic and the IRS collection efforts to contact taxpayers with unfiled tax returns.

Rajbir Athwal, EA

301-461-2022

Comments(0)